We rounded up all the funding deals out of Boston tech companies this week. As more news comes out, this post will be updated.

Friday, July 24

Voxel8 (Somerville)

- Deal: $12 million Series A

- Investors: Braemar Energy Ventures and ARCH Venture Partners led the round with participation from Autodesk through its Spark Investment Fund and In-Q-Tel.

- What they do: Co-founded by Harvard professor Dr. Jennifer Lewis, Voxel8 created the world’s first multi-material 3D electronics printer, which is capable of printing embedded electronics as well as other novel devices (eliminating the need for traditional tooling, inventory and supply chains). Through its collaboration with Autodesk, Voxel8 allows designers and engineers to create freeform, three-dimensional circuits in place of conventional circuit boards to enable entirely new form factors.

- Other details: Voxel8 will use the capital to expand its team and advance its core technology.

AdAgility (Waltham)

- Deal: $1.6 million seed round

- Investors: Tim and Todd McSweeney led the round with participation from existing investor Boston Seed Capital.

- What they do: Co-Founded by two Vistaprint alums, Bryan Seastead and Doug Mitchell, AdAgility is a marketing tech startup that provides personalized, on-site and mobile cross-selling solutions. Its technology helps helps ecommerce sites and publishers better up-sell and delight customers by smartly delivering the most relevant first or third-party cross-sell offer to its users. The company was a MassChallenge Finalist in 2013.

- Other details: This new funding will be used to further accelerate the firm's recent growth. AdAgility's partner portfolio includes GoDaddy, Square, YP, Staples, Intuit and Pitney Bowes, to name a few. Those firms are seeing increased engagement rates of up to 30 times over competitors and yielding 10 times in increased revenue compared to traditional programs, according to the company.

Thursday, July 23

Ginkgo Bioworks (Boston)

- Deal: $45 million Series B

- Investors: Viking Global, OS Fund, Y Combinator and Felicis Ventures.

- What they do: Ginkgo Bioworks is an organism design company that is building organisms to spec for customers across a range of markets including food, health and consumer goods. The company’s organism engineers work directly with customers—some Fortune 500 companies—to design microbes for their specific needs. The firm was founded in 2008 by computer scientist Tom Knight as well as four MIT biological engineer school alumni. Today, Ginkgo Bioworks specializes in engineering microbes for the production of flavors, fragrances, and other nutritional ingredients. The company has locked down 20 organisms design contracts to date.

- Other details: The new funds will allow Ginkgo Bioworks to expand into new health and consumer goods categories such as pharmaceuticals, cosmetics and probiotics, as well as hire additional employees and build out Bioworks 2, the next generation of Ginkgo’s robotic Foundry.

Tuesday, July 21

ACT.md (Boston)

- Deal: $8.4 million Series A

- Investors: The round was led by Rose Park Advisors

- What they do: ACT.md is a provider of a team-based care coordination platform for managing complex patients. The platform connects all members of a care team, thereby enabling more collaborative care planning. The company claims that with ACT.md, healthcare organizations can also reduce duplication and gain efficiencies.

- Other details: ACT.md was founded in 2012 by leaders in healthcare informatics and operations: Dr. Isaac Kohane, Dr. Kenneth Mandl, and Ted Quinn. The firm will use this financing to accelerate product development and help manage the company’s recent growth. They are currently hiring for at least five positions.

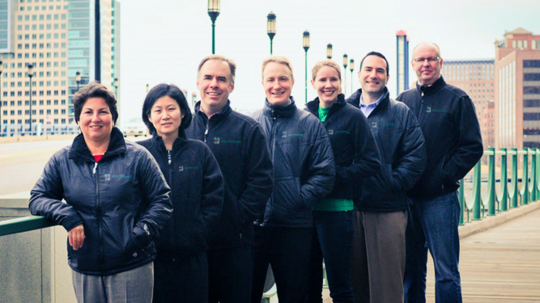

.406 Ventures (Boston)

Deal: $217 million What they do: .406 Ventures is a Boston-based venture capital firm founded in 2005. The firm invests in early-stage technology companies, with a specific focus on cybersecurity, healthcare IT, data/analytics and cloud tech. Its portfolio includes Bedrock Data, Bit9, CloudHealth Technologies and Veracode. Other details: The VC firm claims that $217 million exceeds its initial target for the third fund. In conjunction with this news, .406 Ventures is announcing that it’s adding Payal Agrawal Divakaran, a recent graduate of Harvard Business School and co-founder of SpotRocket, to the investment team as a Senior Associate. Divakaran, who also holds a BS from MIT, previously worked in corporate development at Eventbrite and was also an associate at Spectrum Equity, where she sourced and executed deals in the software, information services, data/analytics, cybersecurity, and Internet realms.

Photo of the team via .406 Ventures.