Boston startup Elsen is looking to accelerate the speed of computer processing at hedge funds and other financial institutions—and now has some funding of its own. The company, founded in 2013 by three Northeastern University grads, on Wednesday planned to announce that it’s raised $400,000 from local angel investor Bret Siarkowski and Atlas Venture’s Boston Syndicates seed-investing program.

Currently based out of the DCU Center of Excellence in Financial Services on Atlantic Avenue, the eight-person team at Elsen soon plans to move to its own office on School Street in Downtown Crossing.

Elsen’s founders are Zac Sheffer, Ryan Johnson and Justin White, and the company is a graduate of Northeastern's accelerator program, IDEA.

The startup plans to use the funding for expansion, including adding to its engineering team. It had previously been bootstrapped.

Processing financial models

Elsen offers a new approach for running financial models that are used widely in the financial services world. For instance, the product can be used to speed up the testing of financial algorithms via “backtesting”; the process taps historical financial data to see how an algorithm would’ve performed at automatically picking stocks, for instance.

The benefit is faster speed when running backtests and other financial models, along with a drop in server costs (and lower carbon footprint in the datacenter), according to Elsen.

The benefit is faster speed when running financial models, along with a drop in server costs (and lower carbon footprint).

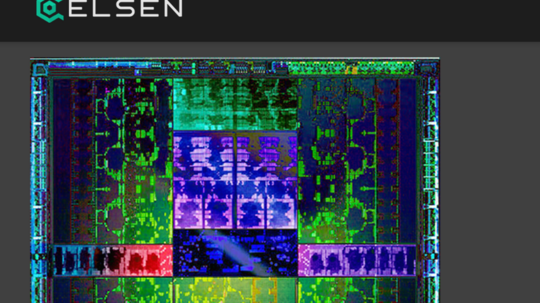

The startup’s cloud software took 18 months to develop and differentiates by enabling what’s known as “massively-parallel processing”—which is powered by simultaneous processing (using GPU, the graphics processing unit) versus sequential processing (which is CPU-based).

Along with hedge funds, Elsen said its product—which is available now—could be used by banks, insurance companies and any others running financial models and algorithms.

In September, the startup announced a deal that would let Elsen provide pricing data from Thomson Reuters to investors.