The day Robinhood, then a rising star in the stock-buying field, decided to limit purchasing GameStop stock, 2,800 miles away, a local startup felt the effects.

It wasn't the loss of potential money to be made, but rather that in one day, Tampa-based stock owning app Grifin saw a more than 1,800% jump in users.

"It was an entire week of spending time with our current and future customers," Grifin CEO and co-founder Aaron Froug said. "We had to shift our engineering team's priorities, we had to shift where the focus was of what we were building. Whatever we had planned for those two weeks was done."

The boom came after a Reddit thread encouraged millions of users to buy low-performing stocks such as GameStop or AMC Theaters. When the Robinhood platform decided to limit buying those stocks, other stock-buying options received an influx of customers overnight.

But while outside investors and users were pointing toward Grifin as an alternative, the founders themselves stayed relatively quiet.

"I don't think we wanted to capitalize off people hurting," Froug said of the millions who were unable to buy or sell their large amounts of GameStop stocks. "There was a lot going on, and we've never seen ourselves as a competitor."

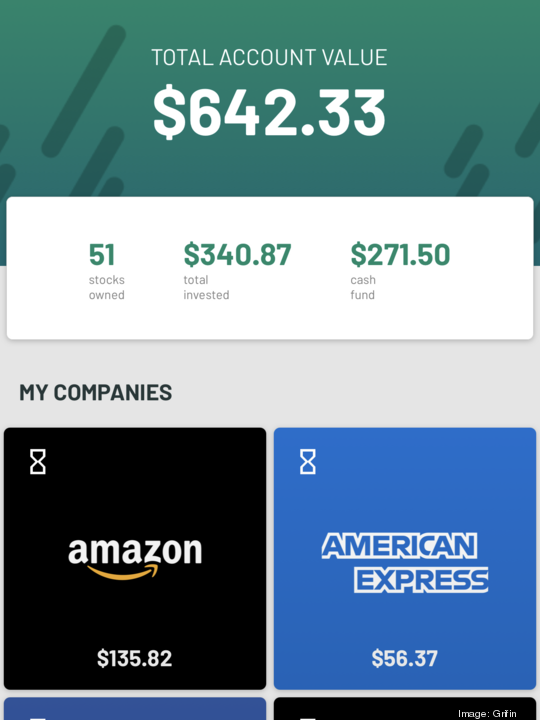

Grifin and Robinhood, which also started as a scrappy startup and is based in Silicon Valley, have very different deliverables. While Robinhood allows users to buy and sell stocks quickly — as evidenced with the buying frenzy around GameStop stock — Grifin was intended to ease into the stock world by letting users simply own a piece of companies they continuously shopped at, such as Starbucks or Amazon.

"In the time where people were looking for alternatives to Robinhood, our position wasn’t, 'We're an alternative,' it was just, 'We're trying to have a different approach to investing in general,'" Froug said. "I just wanted us to say, 'We're here if you need a safe place to go.'"

The company is beginning to double down on that message, as many are feeling the mental toll that comes with following the rise and fall of a singular stock.

"We’re at the very, very beginning of it; we did a Clubhouse meeting to talk about both mental health and the stock market, because there were a lot of emotions and we need to talk about it," Froug said. "That's the position Grifin wants to be in. It's not just about investing, but owing the companies for the long-term, being nicer on ourselves — just finally having a conversation about the things we don't talk about."

While the GameStop drama has subsided, Grifin is still seeing an influx in customers thanks to referrals of users who downloaded the app during the original Robinhood frenzy. Froug said work is just beginning for the company, which officially launched late last year and is made up of a small six-person team.

"We're excited and proud of ourselves but it feels we have such a long way to go," Froug said. "There's so much more we have to do and are going to do, but now that we've seen people are excited about it, it's 'What's next? How do we grow?'"