Majority, a financial tech firm that provides mobile banking services to immigrants, will open a headquarters in Miami after raising $27 million from investors.

The company is rolling out its banking services to migrants across the U.S. who do not have Social Security numbers, which can limit access to financial services such as debit cards and low-fee money transfers.

Founded in 2019, Majority primarily serves the Nigerian and Cuban communities in Texas and Florida, respectively.

“A bank account is the starting point to so many other things for someone moving to a new country, and American bureaucratic delays and backup shouldn't prevent people from being able to establish themselves here,” founder and CEO Magnus Larsson said.

Majority's $27 million series A financing round was led by Valar Ventures, a New York venture capital firm co-founded by billionaire Peter Thiel. The capital injection comes just six months after the startup raised $19 million in seed financing.

The new funds will be used to open Majority's new Miami headquarters and increase hiring in the U.S. and Sweden, the home of the company's tech and product team. The Miami office will have between five and 10 employees when it opens. Majority also has an office in Houston, Texas, the base for its risk operations and customer service divisions.

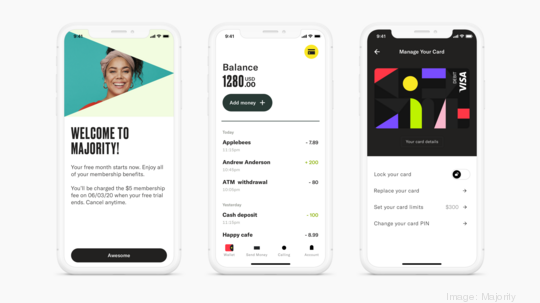

Majority users receive bundled mobile banking, remittances and international calling services for $5 a month – far less than what they would usually pay for all three services. The company reports that it service saves its Cuban members an average of $21 and Nigerian members $10 each month. On top of its platform, the startup has local advisers available to onboard and support new members in their native languages, and hosts local meetups to help members build a sense of community.

In the absence of a Social Security number, many banks may ask for a green card, visa, individual taxpayer identification number or U.S. government-issued ID to register or open an account. Majority only requires a government-issued ID from any country and proof of a U.S. address for users to access banking and money transfer services.

The U.S. is home to an estimated 11 million undocumented immigrant workers and millions of other workers who travel to the country for temporary or seasonal work. And that's just a small slice of the total population: According to the International Labour Organization, there were 169 million migrant workers worldwide in 2021.

That represents a sizable number of people who are not being served by traditional mobile banking products.

“Requiring only a government ID and proof of U.S. residence to register for a banking membership is the latest innovation underscoring how Majority understands the unique needs of this community and works to create the tools to serve them," Valar Ventures founding partner James Fitzgerald said.

For more stories like this one, sign up for Miami Inno newsletters from the South Florida Business Journal and the American Inno network.