Editor note: In our 2022 Startups to Watch feature, the Silicon Valley Business Journal and San Francisco Business Times present startups and founders doing unique things in the San Francisco Bay Area. PrizePool is one of 20 that we have profiled — to read more about our mission and the other startups we're featuring, click here.

PrizePool Inc. is on a mission to help users build a better financial foundation. The company offers a banking account that enters savers into a lottery to win cash prizes of up to $10,000.

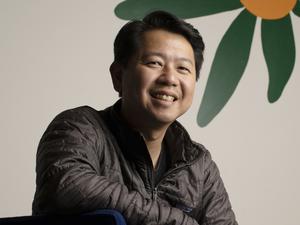

Co-founders Franklyn Chien and Joe Woo — the team behind LearnSprout, which the pair sold to Apple Inc. in 2016 — were attracted to the idea of a savings lottery by an episode of the podcast Freakonomics. The idea of a "no-lose lottery" was intriguing to Chien. Given that only 39% of Americans could afford an unexpected bill of $1,000, he saw the task of building up Americans' savings as crucial.

"Money is a very personal thing ... people don't talk about savings much in our daily lives, which is really unfortunate," Chien said. "We're trying to break that mold that bit and actually talk about savings in a positive way."

PrizePool Inc.

- Founded: 2019

- Founders: Franklyn Chien, Joe Woo

- What it does: Helps people save money through a "savings lottery"

- Headquarters: Palo Alto

- Employees: 13

- Total raised: $14.33 million

- Investors: Bling Capital, Accomplice VC, M13, SciFi VC, World Innovation Lab, 8VC, Hustle Fund, Brighter Capital, Iterative Accelerator, NextView Ventures, Secocha Ventures, Coatue Management

What was the biggest challenge you faced in building PrizePool? Dealing with people's money is often a private and sensitive topic, and gaining their trust and essentially their funds is always the hardest challenge. We've solved this challenge by providing transparency in their odds, as well as showcasing as many of our winners as possible — we've given out around $1 million in prizes to date.

How different is the company you have today compared with the one you first envisioned? We're now expanding beyond just savings, such as our new debit card product and differentiated savings products that are powered by the world of crypto and decentralized finance.

What is the best way for you and your team to work? We're now in a hybrid model where the San Francisco team comes together two or three times a week and the rest of the time, we work from home. We also bring in the entire team together for a quarterly offsite to ensure we're aligned in direction (as well as continuing to build cohesiveness).

Who was the first person or organization you asked for money? Given that this was the second company we have started, a lot of our previous investors were willing to back us again. Ben Ling from Bling Capital was the first one who wanted to write us a check, even when we were just brainstorming the idea.