Reddit's stock closed up nearly 50% on Thursday after its first day of trading on the New York Stock Exchange under the ticker RDDT.

The social media company had priced its shares at $34 and closed at $50.44, a 48% jump from its initial offering, giving the company a nearly $9.5 billion market cap.

The initial offering generated $750 million, and Reddit itself collected about $519 million of that, CNBC reported, with the rest going to investors.

A small number of Reddit users, also known as Redditors, were allowed to participated in the offering and were not held to any lock-up period, which could have contributed to the stock's volatility.

Reddit's largest shareholders include OpenAI CEO Sam Altman, China's Tencent Holdings, Fidelity Investments and Advance Publications — the last or which held just over 30% of Reddit's shares and 34% of the voting power prior to the offering, Reddit previously disclosed.

Advance also owns magazine publisher Condé Nast and local news publisher American City Business Journals, the parent company of the San Francisco Business Times and the Silicon Valley Business Journal. It acquired Reddit through its ownership of Wired magazine, which bought Reddit in 2006 as part of a plan to expand Wired's digital arm.

Reddit's public debut is the first major tech IPO from a Bay Area company this year and the second in six months.

Instacart was only one of four Bay Area companies that debuted last year. The other three were biotechs.

The grocery delivery company debuted in September at $42 and popped 40% during initial trading but dropped below $23 by early January. The stock closed just under $38 on Thursday.

Observers are watching Reddit's debut closely. A successful IPO for Reddit could contribute to a broader thaw.

Santa Clara chipmaker Astera Labs debuted just one day earlier, and its stock jumped as much as 76% during its first of trading, riding a wave fueled by interest in artificial intelligence, Reuters reported on Wednesday.

Other Bay Area company waiting in the wings for highly anticipated IPOS include Databricks, Stripe, Turo and Flexport.

Bay Area IPO Watch 2023/2024

Founded by CEO Ali Ghodsi, San Francisco-based data management and analytics company Databricks has raised $3.5 billion and was valued at $38 billion in 2021.

Todd Johnson | San Francisco Business Times

Former Amazon executive Dave Clark joined San Francisco-based logistics company Flexport in 2022. The company has raised $2.5 billion and was valued at $8 billion in 2022.

Dan DeLong | for the Nashville Business Journal

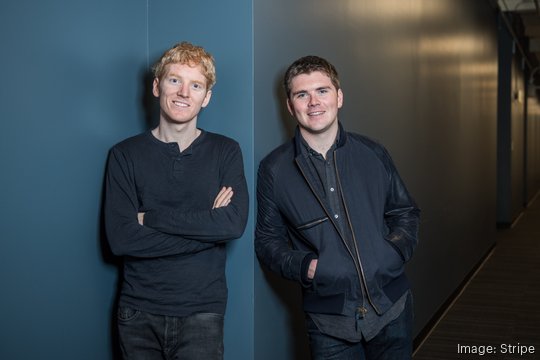

South San Francisco-based Stripe has seemingly shelved its IPO plans, for now, and raised $6.5 billion in a Series I round in 2023.

Stripe

Long tipped as an IPO candidate, San Francisco-based Instacart confidentially filed for an IPO in early 2022 but never moved forward before slashing its internal valuation several times that year. As of April 2023, the company reportedly valued itself at $12 billion, down from $40 billion at the beginning of 2022.

Instacart

San Francisco-based wholesale marketplace Faire has raised $1.26 billion and was valued at more than $12 billion in 2022.

Faire

Burlingame-based mental health services provider Lyra Health has raised more than $900 million and was valued at $5.85 billion in 2022.

Lyra Health

South San Francisco-based Plenty Unlimited has raised $941 million and was valued at more than $1.4 billion in 2022.

Jim Vetter Photography

In April 2023, San Francisco-based blockchain developer Chia Network confidentially filed to go public. It has raised $112 million and was valued at $455 million in 2022.

Chia Networks

San Francisco-based car sharing company Turo filed for an IPO at the beginning of 2022 and disclosed heavy net losses. As of June 2023, it hasn't debuted yet.

Todd Johnson | San Francisco Business Times

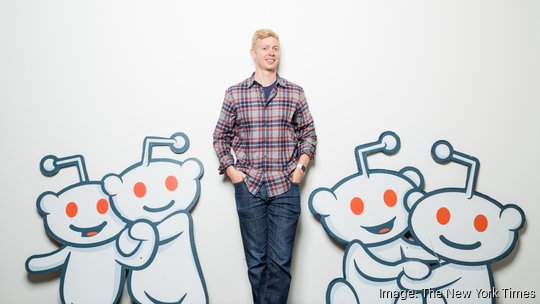

San Francisco-based social media site Reddit confidentially filed for a public debut in 2021 but subsequently delayed. The company has raised $1.3 billion and was valued at $10 billion in 2021.

Jason Henry/The New York Times

San Francisco-based health tech developer Komodo Health has raised around $527 million and was valued at $3.3 billion in 2021.

Komodo Health f

San Francisco-based Plaid has raised more than $730 million and was valued at more than $13 billion in 2021.

Plaid

Formerly known as TripActions, Palo Alto-based Navan, which provides corporate travel management services, has raised a little over $2 billion, including a $100 million debt round. It was valued at more than $9 billion in 2022.

Job Portraits | Courtesy of TripActions