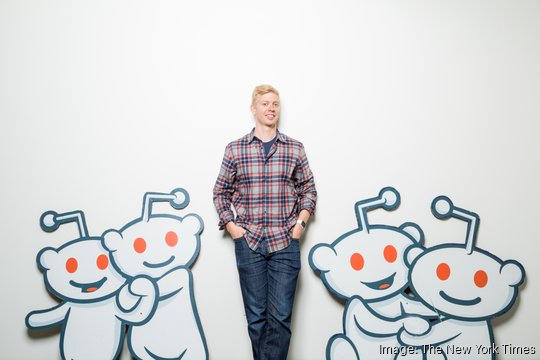

Nearly two decades after its founding, Reddit is finally expected to start trading Thursday after its initial public offering.

Reddit priced its initial offering at $34 a share on Wednesday which valued the company at $6.4 billion, at the upper range of its target but still below its $10 billion valuation in 2021.

Its shares are expected to jump as much as 35% during initial trading, Reuters reported on Thursday, which would value the company at more than $8 billion.

The company also set an unusual rule for some shareholders: Reddit allowed some of its users, known as Redditors, to participate in the initial offering and will allow them to sell immediately.

The move could cause volatility for its stock price, a risk that Reddit acknowledged in its IPO filing.

"Given the broad awareness and brand recognition of Reddit, including as a result of the popularity of r/wallstreetbets among retail investors, and the direct access by retail investors to broadly available trading platforms, the market price and trading volume of our Class A common stock could experience extreme volatility for reasons unrelated to our underlying business or macroeconomic or industry fundamentals, which could cause you to lose all or part of your investment if you are unable to sell your shares at or above the initial offering price," the filing says.

OpenAI CEO Sam Altman, China's Tencent Holdings, Fidelity Investments and Advance Publications were among Reddit's largest shareholders, the company disclosed ahead of its IPO. Advance Publications also owns the San Francisco Business Times and Silicon Valley Business Journal.

Bay Area IPO Watch 2023/2024

The IPO comes after a prolonged freeze triggered by rising interest rates, geopolitical unrest and broad economic uncertainty over the past few years.

However, another Bay Area company took the IPO plunge just a day earlier.

Shares of Santa Clara-based chip maker Astera Labs jumped as much as 76% during its first of trading, riding a wave fueled by interest in artificial intelligence, Reuters reported on Wednesday.

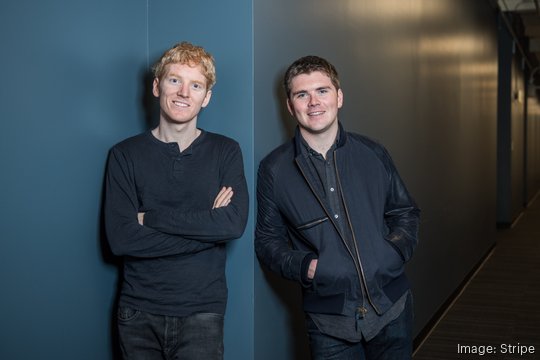

Three other San Francisco companies are high on many observers' IPO watch lists: Databricks, Turo and Stripe. They're among at least 20 companies waiting for the right timing for a public market debut.

Instacart was only one of four Bay Area companies that debuted last year. The other three were biotechs.

The grocery delivery company debuted in September at $42 and popped 40% during initial trading but dropped below $23 by early January. The stock was trading around $38 on Wednesday.

Other Bay Area companies on IPO watch include Flexport, Faire, Lyra Health, Plenty Unlimited, Chia Network, Komodo Health, Plaid and Navan (formerly known as TripActions).