Khosla Ventures is shutting down a second of its four blank-check companies.

Under the terms of its March 2021 initial public offering, Khosla Ventures Acquisition Co. III had two years to strike a merger deal or, barring that, return the cash it raised to shareholders. Having failed to find a partner, the Menlo Park-based special purpose acquisition company (Nasdaq: KVSC) plans to return that money to investors by April 7, it said in a regulatory filing Monday.

"In accordance with the company’s certificate of incorporation the company shall ... cease all operations except for the purpose of winding up ... and ... as promptly as reasonably possible ... dissolve and liquidate," Khosla III said in its regulatory filing.

At the end of last year, Khosla III held $572 million in marketable securities that it had purchased with the cash it raised in its IPO and from subsequent investments, according to its annual report.

The SPAC had planned to merge with and take public a high-growth tech company. But since Khosla III's IPO, interest in blank-check companies has plummeted, thanks to increased regulatory scrutiny and the poor stock performance of businesses that went public through mergers with such entities.

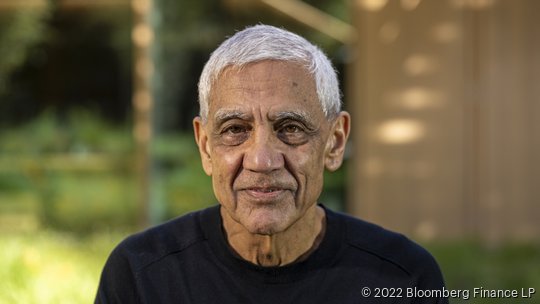

Khosla III's closure comes about eight months after Vinod Khosla's venture firm gave up on another of its SPACs — Khosla Ventures Acquisition Co. IV. That entity was dissolved last summer without ever completing its planned IPO.

Only one of Khosla Ventures' SPACs has completed a merger deal. Khosla Ventures Acquisition Co. II in late 2021 combined with and took public Nextdoor Inc. (NYSE: KIND), the San Francisco-based neighborhood social networking company. Since that merger, Nextdoor's market capitalization has plunged by more than 80% to about $773 million.

The firm's first SPAC, Khosla Ventures Acquisition Co. (Nasdaq: KVSA), which is its only one remaining, has signed a non-binding letter of intent to merge with an unnamed company, it said in a Feb. 14 regulatory filing. That announcement automatically extended the deadline for it to do a deal from March 6 to June 8. Khosla Acquisition hasn't disclosed any additional information since then about its prospective merger partner or the status of their deal.

Here's more Bay Area venture and startup news at midweek:

Fundings

- Graphiant Inc., San Jose, $62 million, Series B: Two Bear Capital led the round for this provider of data networking services. Sequoia Capital, Atlantic Bridge and Harpoon Venture Capital Partners also invested.

- Perplexity AI Inc., San Francisco, $25.6 million, Series A: New Enterprise Associates led the round for this developer of a conversational search engine. Databricks Ventures, Color Genomics Inc. co-founder Elad Gil, former Snowflake Inc. CEO Bob Muglia and Gmail creator Paul Buchheit also participated.

- envZero Inc. (dba env0), Sunnyvale, $18.1 million: Venture Guides led the extension of a 2021 Series A round for this provider of a software development service that manages cloud-based infrastructure. The new funding brings the total raised in the round to $35 million. StepStone Group, Knollwood Investment Advisory, boldstart ventures, Grove Ventures, M12 and Crescendo Venture Partners also invested.

- ConduitXYZ Inc. (dba Conduit), San Francisco, $7 million, Seed: Paradigm led the round for this provider of software for cryptocurrency application developers.

- Playbook, San Francisco, $7 million, Series A: Telstra Ventures led the round for this developer of a personal finance app. Atomic Labs also participated.

- FedML Inc., Sunnyvale, $6 million: Camford Capital led the round for this provider of a collaborative service for training machine learning models. Plug & Play Ventures, AimTop Ventures, Acequia Capital and LDV Partners also invested.

- Substack Inc., San Francisco, between $2 million and $5 million: This newsletter website has opened a community fundraising drive that lets writers who publish on its site to invest in an extension of its 2021 Series B round, according to Axios. The startup originally planned to raise $2 million but has reportedly since lifted the amount to the legal limit for such fundraising of $5 million.

- Paraform Inc., San Francisco, $1.4 million. Pre-seed: Primer Sazze Partners led the round for this provider of provider of a service that pays people to refer qualified candidates for tech jobs.

Funders in the news

- Riverwood Capital promoted Joe De Pinho to partner. The Menlo Park-based private equity firm promoted Alex Porto, and Ramesh Venugopal to partner as well.