Oregon’s biotechnology and life science sector packs a $15.6 billion economic punch, along with $5 billion in income and nearly 66,000 jobs statewide.

That’s according to a new report from the Oregon Bioscience Association. Yet Oregon, and Portland in particular, has fought to win recognition as a bioscience hub. Boston/Cambridge, the San Francisco Bay Area and Seattle dominate those ranks, while Oregon startups have struggled to raise capital, find lab space to accommodate their growth and compete with the established clusters for talent.

That might be changing (though that's been said before). Portland landed on real estate firm CBRE’s list of top 25 U.S. life sciences hubs, coming in at No. 21. Growth has been steady since 2002, with bioscience employment almost doubling.

We gathered four bioscience leaders to discuss the current status and future prospects of the the bioscience sector in Oregon:

- Liisa Bozinovic is the executive director of the Bioscience Association, which advocates on behalf of the industry.

- Dan Snyder chairs Oregon Bio’s board, is founder and CEO of The Playbook and is the former president and CEO of MolecularMD, a Portland molecular diagnostics company that was acquired by a global clinical research organization in 2019. (He participated in the discussion remotely.)

- Heather Ellis is the executive director of the OTRADI Bioscience Incubator, which houses 28 startups on Portland’s South Waterfront.

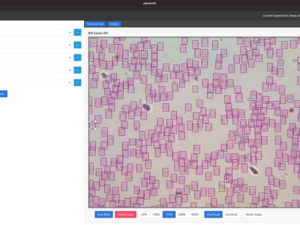

- John Harkness is the president and CEO of Rewire Neuro, an OTRADI tenant that uses AI to help biomedical researchers improve the speed and repeatability of research with automated image analysis.

What is the biggest takeaway of your new economic impact report?

Bozinovic: There was growth in almost every indicator, whether in NIH funding, jobs, wages, economic output, income or taxes. When you break it down by sector in the state, the biggest growth was in medical research and testing and bioscience distribution. I think with the pandemic, that makes sense. The other thing we knew intuitively but that’s good and interesting to see is across the months of 2020, employment grew from the beginning to the end of the year.

OUR FULL HOW OREGON WORKS HEALTH CARE COVERAGE

An Oregon sector that, quietly, generates billions

For Oregon's travel nurses, pay, opportunities remain abundant

There was a little bit of a dip when things shut down, but overall in 2020, employment stayed strong. We’ve always been a recession-resistant industry in general, and we saw that in the 2009 era, but with the pandemic, we were also part of the response, so we saw a lot of companies pivot and shift in diagnostics and PPE work that was going on.

Snyder: Potentially a surprise but also the most impactful (takeaway) was the increase in venture capital investment for the period. More companies are moving from the startup stage to the development stage, and that’s where you need to get to in order to raise more significant dollars from venture capital. A critical piece we’re seeing is a lot of research is happening and we’ve seen increase in terms of startups, but now we’re starting to see those companies able to grow and develop in Oregon.

Ellis: The Covid circumstances of the world allowing others to go virtual brought in the potential for more venture capital in the state because you’re able to have those conversations more easily virtually.

Harkness: 100%

Ellis: As much as the pandemic was a pain point in many ways, for Oregon in particular, it was a way to open doors and have conversations we were not able to have previously.

Harkness: We were able to connect with investors all over the country and wouldn’t have been able to do that previously. Working in a hybrid and remote environment has been good for a company my size. We can really benefit from low overhead.

Did the incubator lose any tenants during the pandemic?

Ellis: We didn’t lose any, and our waitlist was growing. We did graduate Aronora and Vir. We also brought in several companies with innovative ideas who were interested in joining the space.

What are some of the weak points in terms of what Portland offers as a biotech hub?

Snyder: There are five keys for any kind of bioscience cluster. You have to have research institutions, and Oregon is relatively strong on that side of things. The other things are a combination between talent, management and scientific or technical skill sets, and then you need capital, particularly, seed and growth capital, and space and facilities. Our strength is relatively good technical and scientific talent here that comes out of the research institutions, and a lot of people have migrated here from the Seattle and Bay Area ecosystems, so that leaves management, growth capital and space.

Harkness: Something Dan said struck a chord with me in terms of what’s going well, which is the support from Oregon Bio and the academic research community. I would hope to see continued development in that early-capital stage — with three pitch competitions, there is an incredible amount of opportunities available now, but we need to see more of those.

Ellis: Regarding space, it’s hard to help them graduate when there’s no prebuilt space they can shift to. We have to build from scratch, and that’s a challenge. We’re trying to create the pipeline that’s necessary to keep companies in Oregon.

Bozinovic: The larger markets have an inventory of space companies can graduate into as they’re scaling up. Aronora and Vir had to figure that out alone, and it was a lot of work. We’ve got a facilities committee now where we share best practices and we’re looking at how we can have an impact and leverage and inform property owners and managers that this is a good, safe, reliable industry. We’ve heard stories of members having to convince landlords that they’re just as safe as a CVS or safer than a dry cleaner. It will be telling when we become an area where when someone moves out of a lab space it’s not automatically converted back to office. We’ve got real estate folks waiting, and they know it’s coming and they’re about ready to make that bet.

Snyder: Along those lines, if the state were to take notice of the economic impact report, it is worth recognizing that one of the opportunities for the state to facilitate this is to work with the developers that are looking at this opportunity, but the key is how to mitigate some of the risk. Traditional developers want their space fully leased before they build it out, and in this space, that’s not likely to happen. You have to look at the market, not just companies that are organic to Oregon, but that are relocating or that want to find alternative spaces from Seattle or the Bay Area. We may have the ideal office space that could be converted. We have examples of companies wanting to move from expensive ecosystems.

Ellis: There’s been more opportunity for lab space in the suburbs, however the demand is in the city of Portland, and a lot of that is visibility for potential investors and proximity to the airport.

Bozinovic: Hillsboro is motivated. The length of time to pull a permit to build a bioscience facility — it’s ridiculous how quickly they’ll do that compared with other regions.

CBRE recently ranked Portland 21st on the list of top 25 bioscience hubs. What do you make of that?

Snyder: The fact we’re on it as no longer “emerging,” that’s huge. People see the presence of bio and activity going on. For us, we look at what are the regions comparable to Portland. We don’t want to measure ourselves against Boston or the Bay Area. There’s no point. But we do want to measure against Columbus, Ohio, and other developing areas.

How worried are you about the macro economy and rising interest rates slowing biotech investment?

Snyder: Biotech stocks were getting hit pretty hard, even before recent signs. Since biotech is more risky, it tends to be ahead of the curve in terms of shifts in the economy or as a leading indicator. The thing that would be most impacted is growth capital. Probably their risk profile is going to change, so we have to continue to see how we lower the risk profile of companies in Oregon. The thing is, the effect is muted because research and innovation will continue and, if anything, we will see a rebound sooner in this space than other parts of the economy.

Ellis: The other thing you see when there’s a downturn is more entrepreneurs coming out of the woodwork.

Harkness: Health spending isn’t going to go down, so our customers will continue to be alive and well.

What more would you like to see Oregon do to spur the biotech industry?

Bozinovic: An R&D tax credit is definitely on our radar and probably some additional funding opportunities, like the gap fund, would be really interesting to me, but I don’t know if anyone is working on that.

Snyder: There’s a lack of appreciation for the breadth and diversity of the bioscience industry. People often default to pharma and drug development, but that’s just one of five sectors. There’s agriculture, manufacturing and distribution, lab testing etc. That's $8 billion in terms of direct output and $4 billion was international trade and export. Bioscience is a global business and huge opportunity.