Expenses management company Expensify expects to raise up to $243.3 million in its initial public offering, according to regulatory filings.

The software maker is listing 9.7 million shares, with the bulk being sold by insider shareholders, at a proposed range of $23 to $25 per share. There is also an option for another 1.4 million shares to be sold to underwriters at the IPO price, which at the maximum could bring the total up to $279.8 million.

Last month, Expensify filed with the Securities and Exchange Commission for an IPO. The company intends to trade on the Nasdaq exchange under the symbol EXFY.

Want more Portland startup news? Sign-up for The Beat delivered to your inbox twice weekly

The company intends to have three classes of stock. Two of those classes will have larger voting rights and will be held in a trust with CEO David Barrett, CFO Ryan Schaffer, and Chief Product Officer Jason Mills as voting trustees. The trust will control the company for “the foreseeable future," according to the filing.

Expensify makes software that employees in large and small businesses use for expense reimbursement, invoices and bill pay. It also offers a payment card that ties it all together. It has 140 employees.

The company opened an office in Portland in 2017 and soon after moved its headquarters here. In 2019 it bought its building, the historic First National Bank Building in downtown, and outlined ambitious plans for community space as well as a commitment to Portland.

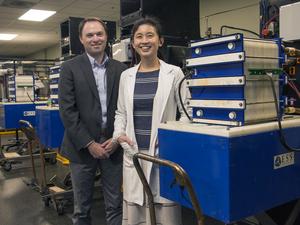

If Expensify completes its IPO it will be third for Oregon this year and the fourth for the Portland metro. Grants Pass-based coffee chain Dutch Bros (NYSE: BROS) went public in September. Wilsonville-based energy storage maker ESS Inc. (NYSE: GWH) completed a SPAC merger in October and started trading on the New York Stock Exchange. Vancouver-based biotech company Absci (Nasdaq: ABSI) went public over the summer.