Management software maker Expensify is the latest Oregon company to file for an initial public offering.

The company moved its headquarters from San Francisco to Portland soon after it opened an office in downtown in 2017. By 2019, it had bought its building and had ambitious plans for office and community space in old First National Bank Building.

The company filed public paperwork with the Securities and Exchange Commission Friday. It intends to trade on the Nasdaq exchange under the symbol “EXFY.”

The company has seen steady growth in revenue and has even turned a profit. In 2019 it reported revenue of $80.5 million and net income of $1.3 million. In 2020, it reported revenue of $88.1 million but swung to a net loss of $1.7 million.

For the first six months of 2021 it reported $65 million in revenue compared with $40.6 million in the same time frame of 2020. For the first six months of 2021 the company reported profit of $14.7 million compared with $3.5 million profit for the first six months of 2020.

The number of shares being offered and the sale price haven’t been determined. The company used a $100 million placeholder number for the filing, but that amount will change.

Want more Portland startup news? Sign-up for The Beat delivered to your inbox twice weekly

The company intends to have three classes of stock. Two of those classes will have larger voting rights and will be held in a trust with voting trustees being founder and CEO David Barrett, CFO Ryan Schaffer, and Chief Product Officer Jason Mills. The trust will control the company for “the foreseeable future," according to the filing.

Expensify makes software that employees in large and small businesses use for expense reimbursement, invoices and bill pay. It also offers a payment card that ties it all together.

In a CEO letter in the filing, Barrett calls it “a corporate card as a Trojan horse for charity” to describe how he sees the company’s products as just the start to enable people to coordinate and combine resources creating a sort of financial social network for those working on the big global challenges facing society.

“Expensify isn't just a corporate card, any more than Google is just a search engine, or Microsoft just an operating system. Both established an unassailable hold on one critical feature, and then built a moat around it a lightyear wide through ancillary features and services,” Barrett writes. “We aim to do the same: to establish a dominant position in business expense management, and then surround it with a wide array of social, consumer, and prosumer functionality that tips everyone's trajectory towards our sun, a little more every day.”

Barrett made headlines last year for sending a letter to customers urging a vote for then-presidential candidate Joe Biden. In a December 2020 interview with the Business Journal, Barrett outlined how business and politics cannot be separated. Throughout the filing the company talks about how it is building its product to help people take on major challenges like climate change.

The company was founded in 2008 and has taken minimal outside funding. It raised $38.2 million from investors.

Since 2008 it has added over 10 million members to its platform and processed 1.1 billion transactions. The company’s sales model is to get in with customers through their employees with a bottom up approach. For the the quarter ended June 30 it had 639,000 paid members across 53,000 companies globally, according to the filing.

The company has 140 employees. In addition to Portland it has U.S. offices in San Francisco and Ironwood, Michigan. Last year it gave up leases in New York City, Amsterdam, London and Melbourne, but the company said in its SEC filings that it will likely sign new leases in those cities.

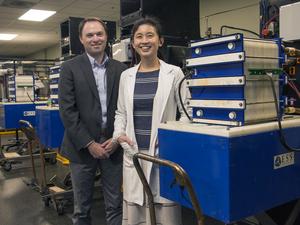

If Expensify completes its IPO it will be third for Oregon this year and the fourth for the Portland metro. Grants Pass-based coffee chain Dutch Bros went public last month. Wilsonville-based energy storage maker ESS Inc. completed a SPAC merger last week and started trading on the New York Stock Exchange. Vancouver-based biotech company Absci went public over the summer.