A Phoenix-based startup that is focused on developing new clean energy technology is under investigation by state regulators for allegedly violating the Securities Act of Arizona.

The Arizona Corporation Commission’s Securities Division issued a temporary cease and desist order in late 2022 to ISA Industries Inc., its founder, Hunter Bjork and his wife, Grace, for allegedly misleading investors about the company’s technology, lack of manufacturing facilities and background of its employees, in addition to conducting unlawful sales of securities.

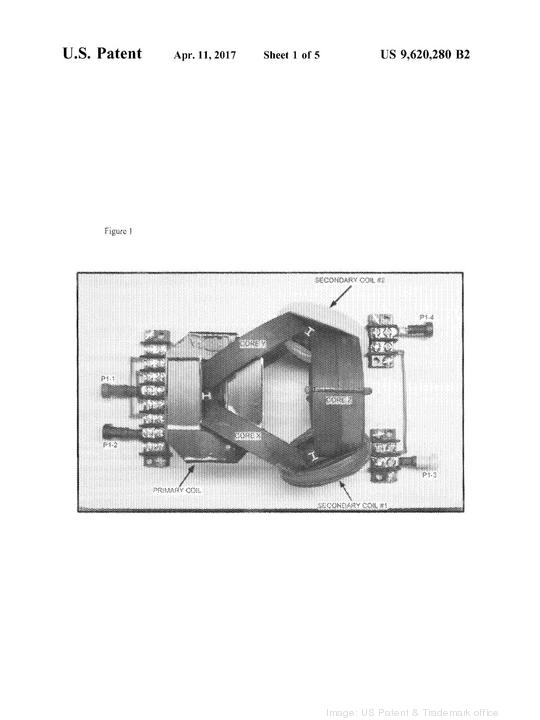

In its cease and desist order, ACC's Securities Division wrote that ISA Industries falsely claimed in private placement memorandums to potential investors that it produces an emerging technology called the “Split Flux," which generates self-replenishing energy and is used by the company’s "strategic partners and government."

“Upon information and belief, ISA has never engineered any technologies and no strategic partners of ISA or governments have produced technologies using the Split Flux device,” the ACC’s Securities division wrote in the order.

ISA Industries describes itself on its website as a "collective of entrepreneurs and engineers who believe that all energy should be inherently sustainable, affordable, and decentralized."

The order also alleges ISA Industries omitted to investors that its core leadership team — consisting of Bjork, Jared Gobler and Skylar Lysaker — have exclusive control over board decisions as they are the only ones holding voting stock, despite the company claiming it has a board of more than six directors that have "complete charge of the business and affairs of the company."

Bjork told the Business Journal in an April 3 email that ISA Industries disputes the allegations in the ACC's cease and desist notice and "will be fully prepared to defend should the case proceed to hearing."

Technology acquired in Arizona

In a previous interview with the Business Journal, Bjork confirmed that ISA acquired its technology from Scottsdale-based AuroraTek, a company run by William Alek, who had obtained a U.S. patent for the Split Flux device in 2017. In May 2020, ISA agreed to purchase AuroraTek and its assets, intellectual property and trade secrets, the ACC order states.

In return, Alek and AuroraTek co-owner Aurora Ellegion would receive 10 million Class A shares of ISA and $1 million each, with 50% withheld until AuroraTek could produce a prototype of its technology, according to the ACC.

In 2020, the ACC ordered Alek, AuroraTek Inc. and Ellegion — who also goes by the surname Light — to pay $742,420 in restitution and a $50,000 fine over alleged securities fraud violations. Alek and Ellegion were also named in a cease and desist order by New Mexico’s Regulation and Licensing Department in 2019 for selling unregistered securities.

In the cease and desist order, the ACC alleges that ISA Industries failed to disclose in its private placement memorandums that Alek had in 2020 been ordered to pay the restitution and fines related to securities fraud.

The Business Journal had previously published an account of the ACC's actions against Alek in an investigative feature article published in 2021.

When interviewed for that 2021 article, Bjork told the Business Journal that investors could trust Alek's technology, despite the previous ACC ruling related to securities fraud.

“Well, the answer is because he's a genius. And he really has what he says he has," Bjork said in the 2021 interview. "So that's part of it. But it's really unfortunate. Like I said, you know, this area of science has been criticized for decades. You know, especially for William Alek, he is an incredibly smart individual, and is one of the most experienced people in this segment of science and physics. And, you know, he's dedicated 25 years of his life to working on this technology.”

Additionally, under the AuroraTek purchase agreement, Ellegion would become chairwoman of ISA at $5,000 per month and Alek would serve as the company’s chief engineering officer for $5,000 a month, the ACC alleged in its order. ISA agreed to set aside “a proper budget to improve the digital and physical reputation of Ellegion and Alek," the ACC order states.

In private placement memorandums, the ACC alleges that ISA Industries also listed Scott Steinman as its chief financial officer and falsely claimed he was a Harvard Business School graduate. However, the ACC wrote, Steinman — at most — attended seminars at Harvard sponsored by his former employers.

Questions raised over investments

In April 2022, ISA sent an email to investors claiming it broke "the world record for the longest sustained fusion reaction" by more than an hour and included a YouTube video link allegedly showing the fusion reaction, according to the ACC.

Further, according to the ACC complaint, in June 2022, ISA approached an undisclosed representative from Acme Engineering Co. about investing in the company. After learning ISA was out of funds, the Acme representative agreed to invest $10,000 for 9,009 shares of ISA pursuant to the company's private placement memorandum issued in April 2022, the order states.

When Acme questioned accuracy of the private placement, Bjork falsely told Acme that ACC's Securities Division reviewed and approved it, calling it the “best it had ever seen," according to the cease and desist order.

ISA provided Acme with a stock ledger indicating the company raised $846,643. When questioned where the funds had gone, Bjork allegedly told Acme the stock ledger was inaccurate and ISA had only raised $595,404, according to the ACC.

That same month, the ACC order claims that ISA asked Acme for a loan of $355,211, of which $86,680 would be used to pay Bjork, Gobler and Lysaker. Acme began conducting due diligence on ISA. The company failed to provide Acme with a reconciliation of its ledger to a balance sheet, resulting in $251,239 in missing funds, according to the ACC.

Further, last August, ISA reached out to an undisclosed Arizona resident who expressed interest in investing in the company via its website, the ACC's complaint states. Bjork allegedly told the resident the ACC's Securities Division had looked into ISA because it was acquiring AuroraTek. He did not disclose the orders of securities fraud against AuroraTek, the ACC alleges.

Last September, ACC’s Securities Division filed its temporary cease and desist order against ISA Industries, citing alleged violations of the Arizona Securities Act.

ACC's Securities Division is requesting ISA Industries take action to correct “conditions resulting from the company’s acts, practices or transactions," including a requirement to make restitution as well as pay state administrative penalties of up to $5,000 per violation.

A hearing regarding the cease and desist order is slated for 10 a.m. on Aug. 21 at the Arizona Corporation Commission's offices in Phoenix.