Two startups walked away with a combined $725,000 in investment offers on Thursday during the "Lion's Den" competition as part of the Philadelphia Alliance for Capital and Technologies’ 2023 Capital Conference.

The competition, now in its ninth year, is styled after hit ABC show "Shark Tank." Held at the Philadelphia Downtown Marriott, the event brought together a group of Greater Philadelphia's most recognizable faces in business looking to invest in some of the region's most promising startups.

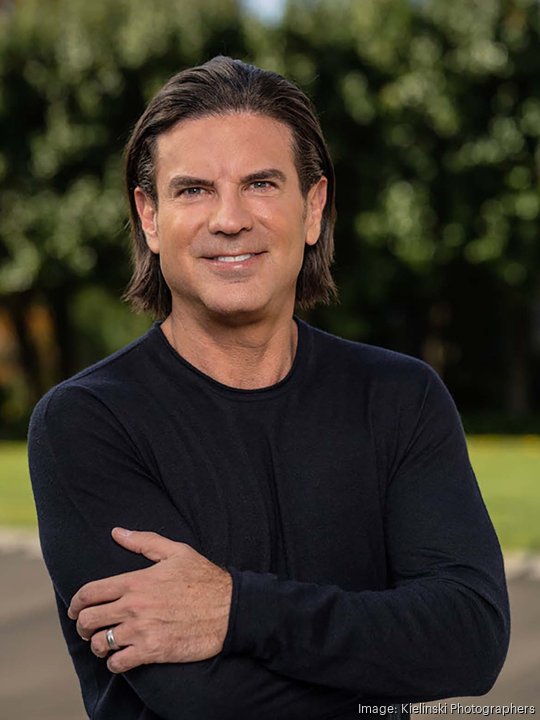

This year's "lions" were Darco Capital founder and Campus Apartments CEO David Adelman; Devon Hill Capital Partners founder Dr. Robert Corrato; Tendo CEO Daniel Goldsmith; COMSCOP Corp. CEO Paul Graziani; and SEI Investments CEO Ryan Hicke.

The three startups selected to pitch potential investors were Rego, Fashionkind, and Impact Wrap, all of which are based in Philadelphia.

Both Rego and Fashionkind snagged investments, while Impact Wrap was unsuccessful in its bid to woo the judges.

Based out of the University City Science Center, Rego uses artificial intelligence to calculate the costs of moving furniture out of an apartment and divert usable furniture that would otherwise be thrown out to nonprofits. Those organizations can in turn sell the goods, supporting their missions. Rego uses third-party haulers and scheduling software to sync pickup times with move outs. In his presentation, CEO Josh Mastromatto said the company had revenue of $50,000 from removals this year, a number he hopes to increase 10 fold over the next 12 months.

Rego, which was also crowned this year's Inno Madness winner, is projecting having revenue of $1.5 million between 2024 and 2026 as it ramps up partnerships with high-end apartment buildings. As of April, the company had been primarily self-funded and secured $231,000 from accelerators.

To help scale the company, Mastromatto sought a $465,000 investment at a $5 million valuation. Unconvinced by that valuation figure, Adelman said he would invest $100,000 if Rego lowered its valuation to $3 million. The part-owner of the Philadelphia 76ers noted his portfolio of 25,000 apartments would be a boon to business.

In addition to Adelman, Corrato and Graziani offered to invest $75,000 and $50,000, respectively, if Mastromatto agreed to the $3 million valuation. Ultimately he did and walked away with a total investment offer of $225,000.

Following Rego's successful bid, another sustainable brand pitched itself to investors. Fashionkind is a retail platform that sources sustainably designed clothes from artisans across the world. It was founded by University of Pennsylvania alum Nina Farren and the company has amassed an online following of 80,000 people. That is in part thanks to the help of co-founder Sophia Bush, the actor known for her roles on The CW's "One Tree Hill" and NBC's "Chicago P.D."

To scale business, Farren is currently raising a $2 million seed round and has already secured $700,000 toward that goal. During her pitch, Farren said she is ultimately "building for acquisition," noting that the seed funding will go toward "fueling growth." Specifically, she is looking to ramp up marketing and to add to her headcount.

Fashionkind is projecting $8 million in revenue in 2024 and $15 million in 2025. The company had received a valuation of $10 million.

Goldsmith said he would invest $250,000 with "the right economics." Corrato and Hicke also agreed to back the firm with investments of $100,000 and $150,000, respectively, but only if Fashionkind's valuation came down. After haggling over the figure, Farren agreed to a $6 million valuation cap to secure a combined $500,000 investment.

The last startup to pitch was also the only one to walk away without a deal. Impact Wrap was founded by Dan Fradin. The startup has a device that clips onto punching bags and tracks the frequency, power and speed of kickboxing workouts.

Impact Wrap is in close to 300 gyms, a figure it hopes to grow nearly triple in 2024. Since its founding in 2017, the company has total revenue of $1.5 million. As it ramps up growth in business-to-business sales, Fradin projected that number would grow to $3.8 million in 2024.

Heading into the Lion's Den, Fradin said he was looking to raise funds as part of a $250,000 seed round. Of that, he said he had a verbal commitment from an outside investor for $125,000. Following a seed round, the Impact Wrap founder said he would look to raise a Series A of between $8 million to $12 million as early as February.

The disconnect between the seed round and Series A was too great for the investors, who opted not to make offers in the burgeoning business.