Investors look for numbers and proofs of concept when they receive pitches, but for social impact startups it can often be difficult to quantify that impact.

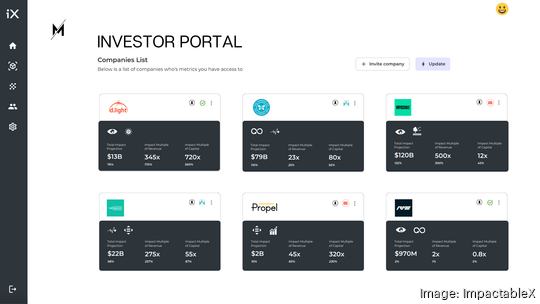

With Philadelphia-based ImpactableX, University of Pennsylvania alum Catherine Griffin is working to change that, and her analytics platform has helped startups raise over $180 million within a year of using the technology.

After completing the TechStars Anywhere accelerator in the first quarter of this year, ImpactableX is using that as a springboard to advance its analytics platform by leaning into artificial intelligence.

The idea for ImpactableX came when Griffin was a managing partner at GoodCompany Ventures, an investment firm that works with socially conscious startups. GoodCompany joined the Obama administration's Climate Data Initiative alongside major institutions like NASA, the United Nations, Google and the World Bank. Those institutions wanted to connect with the startups in GoodCompany Ventures' portfolio, but the founders had trouble articulating the potential impact they could have when scaled.

Griffin put together a suite of "off-the-shelf tools" to help social impact entrepreneurs evoke just how much of a social impact their company could have. That includes tracking hundreds of metrics like kilowatt hours powered by renewables, number of unbanked people served, or access to a given resource for an underserved population.

"Their products and services, when delivered at scale, could potentially move the needle on some really tough challenges," Griffin said. "So we developed them this sort of scaffolding behind Impactable[X]. Long story short, the founders came back to us and said this was really helping them win pitch competitions, close rounds and accelerate their growth."

After five years at GoodCompany Ventures and a year of due diligence, Griffin officially launched ImpactableX in early 2021 and now has a team of eight. It's worked with over 100 companies, along with numerous impact funds, accelerators and brands, a number of which are local, she said. That includes Philadelphia-based companies like Simply Good Jars, Wearwell, HipCityVeg and ROAR for Good, along with Permit Capital, a fund that is now part of Cerity Partners.

Griffin said she didn't set out to "raise a bunch of money to build software." She used tools available to her at first, like Google Analytics, but the TechStars accelerator helped ImpactableX begin to build out its own software. It also opened a pre-seed round, raising $100,000 toward a goal of $750,000. Griffin declined to disclose individual investors in the round so far.

She hopes to use the funding to hire three more people, and said she'd "love to hire locally." Her marketing team is based in Philadelphia, but others members of the team are remote. Like a lot of the tech world, the firm is seeing how it can leverage AI to ramp up growth. It recently launched an AI element to help startups better define and track relevant metrics — and in turn help ImpactableX grow its reach.

"That's really going to enable us to scale because we do quite a bit of research for every company in order to run the analytics," Griffin said about the AI. "That research will be handled by AI, and so that will really take the lid off and enable us to scale much more quickly."

The recently completed TechStars accelerator, the fundraising and the lean into AI make this a "pivotal time" for ImpactableX, Griffin said.

Griffin also sees opportunity to scale ImpactableX quickly as funds, accelerators, and venture firms put more emphasis on investing in startups and ideas that have socioeconomic and environmental impact. One report estimated the market size for impact investing is $495.82 billion in 2023, and expected to grow at a compound annual growth rate of 17.8% through 2027. That would put its value at nearly $1 billion.

As the market continues to grow, investors want to see their investments make tangible change.

"It's really just exploded. And the [limited partners] that are investing for impact want to see results and so that's really pushing fund managers to think about this with a little bit more rigor," Griffin said.

Thus far, startups using ImpactableX have been able to pull in funding from some of the biggest names in venture capital. They include Andreessen Horowitz, Kleiner Perkins, Kapor Capital and BMW's BMW i Ventures. Though growing, Griffin still sees ImpactableX as early in a journey that she hopes can ultimately shift the landscape of impact investing and social impact entrepreneurship.

"We want to be the platform that elevates the sophistication of impact analysis to the level we're accustomed to with traditional finance," Griffin said. "I think that that's going to unlock more capital from the sidelines and improve the legitimacy of social impact as a field."