The NYSE American exchange has commenced the delisting process for the common stock of Navidea Biopharmaceuticals Inc., a decision the Dublin company on Monday said it would appeal.

With recent funding deals under a consulting agreement with a private equity fund, the biotech has advanced clinical trials and made other progress such as hiring a CFO. However, a news release seemed to acknowledge a possible return to over-the-counter trading.

“Although the traditional exchange has been a part of Navidea’s history and may be in the future, our strategy and approach remains resolute in the face of change,” Josh Wilson, a member of the board of directors, said in a statement. “The company’s progress is clear and the impact of the changes we have made will continue to move us forward."

NYSE American declined an interview request, but pointed to its rules for listing. Company representatives were not immediately available.

The deadline passed on Friday for Navidea (NYSEMKT: NAVB) to return to compliance with the exchange's rules under a plan approved in 2022. The company has an accumulated shareholders' deficit and has had annual losses for most of its history.

Navidea has seven days to appeal and said in Monday's release it intends to do so. The stock would continue trading while the matter is pending. If it is ultimately delisted, the company would make arrangements to trade over the counter, according to a release on Friday.

The company hired Craig Dais as CFO on Thursday, according to a regulatory filing. He has been CFO most recently of Colorado Pain Care LLC, fractionally at Ascent CFO Solutions, and of Duffy Crane & Hauling, as part of a 30-year career, according to a release. He reports to Chief Medical Officer Michael Blue, appointed this spring.

Joe Meyer, the director of finance and accounting who had been principal accounting officer in the absence of a CEO, announced he would resign as of Aug. 11 after more than six years with the company, according to the regulatory filing.

Shareholders on Thursday voted to authorize the board to enact a reverse stock split to shore up the share price, according to a regulatory filing. If the board acts, the split would be between 1-for-20 and 1-for-50 shares.

Shareholders also approved issuing 26 million shares to John "Kim" Scott Jr., Navidea's vice chairman, to satisfy the last $1.4 million of his loan to the company last year. Certain institutional investors who could shore up operations first want the debt erased and conversion of a class of preferred stock that Scott owns, the company's most recent proxy said.

"The company is required to have an aggregate net worth of at least $6 million or a market capitalization of at least $50 million prior to July 31, 2023, in order to maintain its listing on NYSE American and is therefore in urgent need of additional equity capital," the proxy said.

Navidea's current market capitalization is $9 million, according to Yahoo Finance.

Several recent financing deals helped the balance sheet, including a $7.5 million cash payment from Cardinal Health Inc.

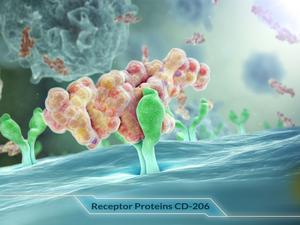

Navidea is developing various diagnostic and eventually therapeutic drugs by attaching different payloads to a molecular backbone attracted to a protein on the surface of white blood cells during inflammation. A rheumatoid arthritis diagnostic is in the third phase of human trials.

The company had just $2 million in cash at the start of the year, after a $17 million 2022 loss. In March, Navidea hired G2G Ventures, a private equity firm founded by a biotech veteran, as a consultant to lead the turnaround. In the first quarter this year, it has slashed administrative expenses by more than one-third, according to a release.

The stock has been delisted before. The company joined the exchange formerly called Amex in 2011, right before changing its name from Neoprobe Corp., after about a dozen years as an over-the-counter stock after delisting from the Nasdaq.

Navidea has received seven warning notices for delisting in the past five years.