Starting the year with just $2 million in cash and almost no revenue in sight, Navidea Biopharmaceuticals Inc. is counting on an ongoing fundraising effort to keep its doors open and finally get a "promising" drug through regulatory approval.

Board members of the Dublin biotechnology firm are "actively engaged" in talks with sources of outside capital, said Dr. Michael Rosol, chief medical officer, in a recorded webinar with investors this week after reporting larger 2022 net loss than the prior year.

"It's no secret the company has been in a resource-limited environment," Rosol said to a stockholder who asked bluntly how many more months the company can operate. "We're optimistic we'll announce something around a capital infusion soon."

Rosol said he could not disclose further details of the talks.

"Our goal is to be fully funded this year," he said in prepared remarks.

If successful, the funding would help open more trial sites and complete enrolling of patients in the final phase of human trials for Navidea's diagnostic imaging drug for rheumatoid arthritis. Once that study is complete, the company will apply for U.S. Food and Drug Administration approval.

"We have these initial promising data in hand," Rosol said. "If these current results hold, we will be in an even better position."

Executives said raising capital also would likely end the more than year-old warning that the company's stock faces delisting – the fifth such warning in five years. And Navidea would hire for key positions to advance the drug and form relationships with outside pharmaceutical companies.

Navidea projects $41 million in annual revenue if the drug is approved, Rosol confirmed on the call, but the timing will depend on how quickly the study and FDA approval process play out.

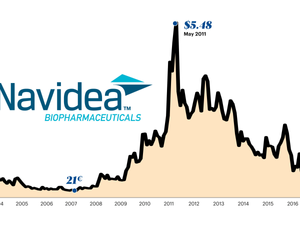

For 2022, revenue decreased by 88% to $66,000 in 2022 from $532,000 the year before, while the annual loss widened to $17.2 million from $11.7 million.

The company last raised $5.2 million after expenses in a rights offering, according to regulatory filings.

More than a decade of research behind drug

Pharmaceutical development and approval is always a long road. This journey was further impeded by the cash crunch, Rosol said, slowing the ability to add clinical sites and enroll patients in trials.

Navidea has been developing its biochemical platform since 2014: a molecular chain it calls manocept, which is attracted to a protein on the surface of certain white blood cells when they are in an inflammatory response.

On that backbone the company proposes adding various payloads for targeted diagnostics and therapeutics.

The first is aimed at rheumatoid arthritis, a painful condition treated with expensive immune-suppressing drugs that can have severe side effects. Navidea will seek approval for using the drug in imaging to quickly identify when a patient is not responding to the treatment, and to predict which patients are unlikely to see benefit.

"There is a large unmet need for a reliable early predictor of whether a therapy is working on a patient's rheumatoid arthritis, and identify early when patients are not responding," Rosol said. "The data we're bringing to the table so far are significantly better than anything out there."

Staying on a treatment that's not even working can cause long-term health consequences along with wasting money, he said.

Once the diagnostic hits the market, he said, the molecular backbone also can be used to develop "powerful" therapeutics.

Meanwhile, Navidea received a notice that the government is in the final stages of issuing a patent for a method using manocept to help the body's immune system attack cancer.

"We have this great opportunity to really shake up the world in this therapeutic domain," Rosol said.

The company is in talks with pharmaceutical companies that could incorporate a Navidea imaging agent in studies of their own drugs, or to license the technology.

Navidea has no CEO or CFO; Rosol is the principal officer. Erika Eves, vice president of finance and administration, is resigning at month's end. Joseph Meyer, company controller, will take over as the top financial officer.

Directors have deferred compensation for several months, in some cases a year.

The share price has been less than $1 since last May, and less than 40 cents since August.

Longstanding lawsuits with a former lender and former CEO are winding down, and Rosol said the company has taken steps to minimize further risk from those battles.

Navidea has successfully brought a drug to market before, Lymphoseek, used in breast cancer surgery to find the lymph nodes most likely to show evidence whether the disease has spread. Dublin-based Cardinal Health Inc. bought the U.S. marketing rights, but the partnership to market the drug in Europe has fizzled.

"Their strategy, we might say, was not optimal," Rosol told an investor. The company is seeking a new European partner.

"The major thing holding us back as a small company has been resources, financial resources," Rosol said. "So we're very good at making a lot happen with a little. Things are different now than they used to be."