Root Inc. expects narrower losses in 2022 from expense controls and faster than expected sales growth in its partnership with Carvana Co., executives said Thursday after the company reported a $521 million net loss for 2021.

Meanwhile a $300 million line of credit from BlackRock gives the digital insurer cash to stick with its strategy. Root cut operating losses in half by the fourth quarter compared with the second, and projected a 25% reduction in operating losses for the first six months of this year.

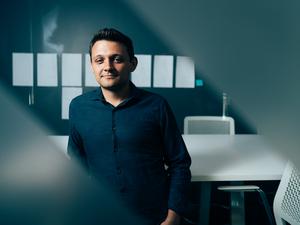

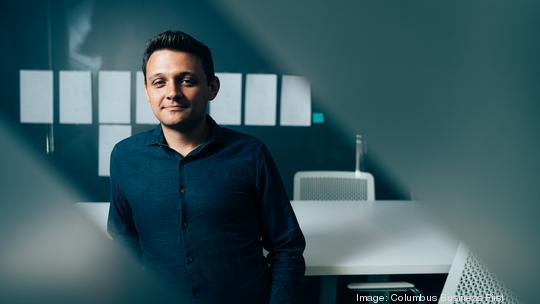

"We’re excited that over the last couple of quarters we have hit our stride from a strategic standpoint and from an operating standpoint," Dan Rosenthal, CFO, COO and chief revenue officer, said in a call with analysts. "We see line of sight to profitable unit economics that will help protect the cash position that we’re in, and we have the capital to execute on the strategic priorities we've laid out."

Root (Nasdaq: ROOT) shares closed at $1.45 on Wednesday, a new low in its drop from $27 at its October 2020 IPO. The stock started climbing somewhat late Thursday morning.

A month ago Root cut 330 jobs, one-fifth of its workforce, in a further move to cut expenses.

The Columbus company beat at least one analyst's expectations for the fourth quarter, with faster premium growth and narrower losses than modeled, according to a report by Elyse Greenspan of Wells Fargo.

Revenue of $345 million was down from $347 million in 2020 even though it sold more policies: Gross written premium grew to $743 million from $617 million the prior year, but Root now cedes more of its premiums to reinsurers to somewhat shield it from losses.

All auto insurers saw historic increases in claims losses last year because supply chain disruptions increased the costs for parts, labor and new cars. Root's data analytics team saw the trends early, so it was able to raise premiums faster than competitors, co-founder and CEO Alex Timm said on the call. It raised rates eight times in the fourth quarter and five times already this year.

The exclusive Carvana deal, which went live in October, pops up an offer for a Root policy when customers are buying from the all-digital auto seller.

"The quality and effectiveness of what we've been able to build in less than six months has surpassed expectations on both sides," Timm said.

Embedding its policies at the moment people need insurance is a "gigantic opportunity" that's more effective than broad marketing, he said.

"We think we’re at the tip of that spear," Timm said.

The company also announced the promotion of Matt Bonakdarpour to CTO from chief data science and analytics officer; he joined as a data science vice president three years ago. Hemal Shah, who had been chief product officer, has resigned. He joined the company from Facebook in 2019.

Bonakdarpour has effectively been interim CTO since the resignation of the replacement for co-founder Dan Manges, who stepped down in June.