Root Inc. has borrowed $300 million from BlackRock Financial Management Inc. – with the world's largest asset manager betting that the stock that has fallen below $2 a share in recent weeks will climb above $9 within five years.

Struggling through ongoing losses, the digital auto insurer closed the five-year term loan facility on Wednesday and expected the funds Thursday, according to a regulatory filing. The interest rate is 9% plus the Fed's Secured Overnight Financing Rate, which currently is 0.04%.

"We are excited to form a long-term partnership with Root," Mark Lawrence, managing director on BlackRock’s global credit team, said in a news release. The firm "recognize(s) the potential" of Root's recent exclusive deal with Carvana for its policies to be offered at the point of online auto purchase, he said.

The two had announced the agreement on the loan last week, shortly before Root terminated some 330 employees – 20% of its workforce – mainly in sales and engineering. The company did not immediately respond to a question from Columbus Business First about whether expense cuts were a condition of the loan.

The Columbus parent of Root Insurance Co. has declined interview requests until after it discusses fourth-quarter results with analysts on Feb. 24. Through the first nine months of 2021, the net loss had hit $411 million on $252 million revenue. The company, which sold its first policy in 2016, has never been profitable amid aggressive nationwide growth.

"This additional capital, along with its focus on lowering its expenses, should help Root to go longer before it burns through its cash position," Elyse Greenspan, senior equity analyst for Wells Fargo Securities LLC, said in a research note.

Root (Nasdaq: ROOT) issued warrants to BlackRock in conjunction with the loan that allow the firm to buy up to 5.66 million shares at $9 apiece, about $51 million, which represents 2% of outstanding shares today. The warrants expire either Jan. 27, 2027, or when Root repays the loan in cash – so BlackRock will profit only if the stock exceeds $9 before then.

New York City-based BlackRock (NYSE: BLK), with $10 trillion in assets under management, also has the right to appoint two non-voting observers to Root's board.

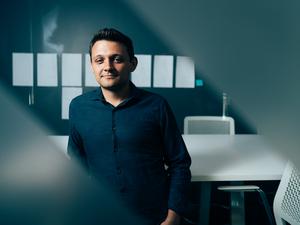

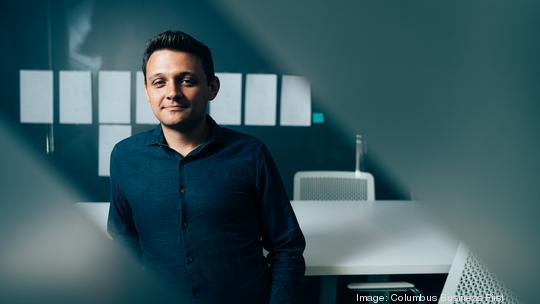

Root co-founder and CEO Alex Timm said BlackRock is "focused on the long-term success of Root."

"We are executing on a disciplined strategy to create enduring value through strong underwriting results, the development of our embedded product (with Carvana), and prudent capital management." Timm said in the release.

Root had $835 million of cash and cash equivalents as of Sept. 30, according to its latest quarterly report. In October, Carvana closed its investment of $126 million in the company.

Its capital and surplus for insurance purposes was $82 million at Sept. 30, according to its report with the Ohio Department of Insurance, well above the $2.5 million minimum required in state law.

The company had Ohio's largest ever IPO in October 2020, debuting at $27 per share but plummeting throughout the year. The stock fell below $3 early this month and below $2 after last week's job cuts.

Expecting more loyal and profitable customers from the Carvana deal, Root slashed marketing expenses starting in fall.

"Our sense is this could imply lower growth for a longer period of time," Greenspan's research note last week said. "We continue to have a more cautious view on the personal auto space given the elevated loss trend environment."

The entire personal auto market is troubled, Greenspan of Wells Fargo said in December when downgrading Allstate's stock. Accidents are increasing as people start driving more compared to earlier in the pandemic, while the costs of repairs and replacement cars are skyrocketing due to shortages of both labor and parts, especially microchips.