Two years ago, serial entrepreneur Matthew Bellows found himself frustrated by financial advising technologies. Bellows was struggling with trying to figure out how he could save for his children to go to college while also caring for his mother and deciding what he could contribute to charity, among other things.

Bellows wanted to turn to a software solution to figure out his financial situation — but, he quickly realized, there wasn’t anything. So he wrote up a 20-page concept document for a startup called BodesWell, a B2B software-as-a-service (SaaS) platform.

“I want to travel with family and see other places. There's all of these overlapping things, and so the pain is, is it all going to work out?” Bellows asked. “That’s why it’s called BodesWell: It’s trying to do a good job of boding, it’s trying to tell you the future, and it’s trying to be optimistic about the future.”

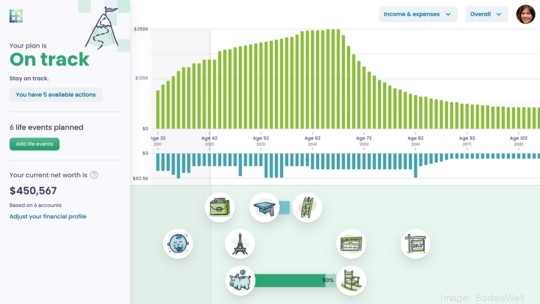

BodesWell uses personal financial data and futuristic economic models to “take away the overwhelming aspects of financial planning,” according to its website.

Bellows said the software was developed to provide the 85 million American households that don’t currently have a financial advisor with options for their financial futures, and to ultimately address wealth disparity in the U.S.

BodesWell’s software, Bellows argues, can provide the same benefits that a financial advisor can, allowing people to map out their own financial journeys without a human looking over their shoulder. The information the software can provide, he said, has always been there but felt out of reach for many.

“All this stuff exists, but it’s unevenly distributed. It’s distributed primarily to the wealthiest part of our country and to the people, frankly, who feel most comfortable working with the current financial advisors,” Bellows said, adding that the average financial advisor is a 55-year-old straight white man.

BodesWell’s model is to team up with big banks and other large financial institutions to reach loyal customers who may be apprehensive about speaking with a financial planner. The bank would send a client an email inviting them to try the financial planning software — sort of a warm introduction to the technology.

“A lot of [banks] hire financial advisors already, but they know millions and millions of their customers don’t relate with financial advisors,” Bellows said.

Bellows said the idea is not to get rid of financial advisors but to allow software to do financial projections and data entry for those customers looking for options. He said financial advisors should be like coaches to help people make difficult choices when it comes to finances.

BodesWell was founded by Bellows and Bernie Bernstein, whose technical knowledge enabled the startup’s SaaS approach. Bernstein, now chief technology officer, worked with Bellows to assemble a small team of six to get the company off the ground.

Two years later, the fintech startup has found its first customer and is a member of this year’s MassChallenge FinTech accelerator program.

Bellows encourages people to test out the software for free at the bodeswell.io website to map out life events and plan long-term financial goals. He hopes his software leaves people feeling like they have more say on what is possible for them financially.

Over the next two years, BodesWell plans to expand its staff to 15 or 20 and partner with more financial institutions. It also hopes to bring on up to 500,000 beta users, an increase from the few thousand who have tested the software so far.

Bellows said many Americans want certainty and creative solutions when it comes to handling some of the overwhelming aspects of financial planning. BodesWell’s technology is not meant to disrupt things for large banks and financial institutions, but rather help them fight off challengers in a dramatically competitive environment.

“So much of the message that we get from financial institutions now is like, ‘You’re screwed, you don't have enough, it’s not going to work out,’” Bellows said. “We want to be providing people an unbiased view into what the future of possibilities are for your life and then help you get there.”

Jordan Frias is a contributing writer for BostInno.