Boston-based FlatWorld – a publishing company trying to rewrite the rules of the higher-ed textbook industry – says its business model of selling cheap college books by expert authors is setting the company up for its next chapter in growth.

FlatWorld, which touts tomes for under $30, has this first quarter of 2018 added 11 titles to its total menu of 125 texts, saw the number of professors assigning its books surpass 4,000, and has increased its workforce to more than 50. The company’s revenue is now “in the solid millions” and it could one day go public, said the company’s co-CEO Alastair Adam.

“We think we can really grow this,” said Adam, a private equity investor. “Our latest projections are anywhere between 50 percent and 100 percent growth this year.”

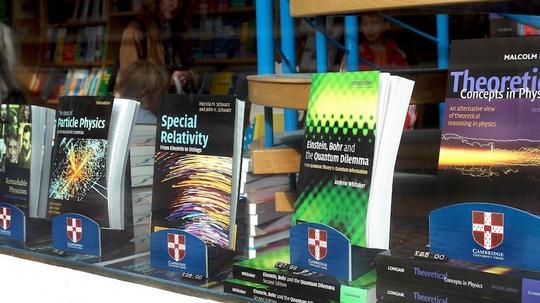

With its print-on-demand model, FlatWorld offers digital textbooks for around $25 to $30 and hard-copies for $10 to $25 extra.

But the opportunities and risks for the company are big. Vying for a piece of an industry estimated to be as large as $6 billion and dominated by traditional publishing giants like Pearson, Cengage, McGraw-Hill Education and even Amazon, FlatWorld is competing with established textbook companies with big reputations and cash.

FlatWorld is also in a market with some free and low-cost options, such as from other small operations like OpenStax out of Rice University. And, right now, rentals as well as used books are eating at new sales, offering other cheaper alternatives.

In 2014, consultants McKinsey & Company found that rentals, for example, were cutting into the higher-ed textbook market so much so that one in four students preferred renting over buying. They predicted that rate to jump this year to 30 percent – the same predicted share as for used books. Last year, Pearson entered a deal with IndiCo, a subsidiary of the National Association of College Stores, to allow students to rent 50 of its texts for under $100.

"Learning companies are addressing college affordability by transitioning to less expensive digital learning materials and helping facilitate inclusive access programs," said Marisa Bluestone, communications director of the Association of American Publishers, in an email to BostInno. "Their efforts have helped result in reduced student spending on necessary course materials. More students than ever are using less-expensive digital materials, renting their course materials and are shopping around the competitive retail market."

But Adam bets FlatWorld can compete against traditional college books – whose titles can still easily cost students as much as a JetBlue flight from Boston to D.C. – and the rentals and used texts, too, because of price.

The average full-time college student attending a public institution still pays about $1,298 annually on books and other course materials, according to the nonprofit group, The College Board.

“At [our] price points, which are sort of like pizza and a movie, and not an airline ticket, people say, 'Why wouldn’t I spend that?'” said Adam. “Most of the students will say there’s no point in getting an old edition [or a rental].”

He likens FlatWorld, in fact, to the business of cheap flights. “You drop the cost and you fill the airline up,” he said.

Founded in 2007 by two former Pearson employees who wanted to bring inexpensive texts to the market, FlatWorld was originally backed by venture investments, but in 2016, Adam and John Eielson, also a co-CEO, bought the company for an undisclosed amount, and moved the headquarters to Boston. Both Adam and Eielson are of the private equity firm Boston Growth Capital.

The books are in use at schools across the country, including several in greater Boston such as Bentley University, Berklee College of Music, Boston University, MIT, Emanuel, Fisher, and Tufts, said Adam. Authors of the texts include prominent names such as economists John B. Taylor and Akila Weerapana, chemist David W. Ball, and technology expert John Gallaugher.

Today, FlatWorld is no longer venture backed and is debt-free, said Adam. And, going public one day, could be an option, he said.

“Sure, this is a really big market… Quite quickly, you could get to a size where it might make sense to go public. At the moment, it’s not that we need the capital for growth, but someday, absolutely.”