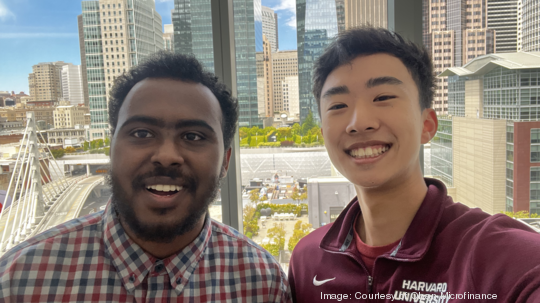

Two Harvard University students—one from Burlington, Mass., and the other from Bahir Dar, Ethiopia—are preparing to launch a new app in Nigeria.

Matt Tengtrakool, 19, and Hileamlak Yitayew, 20, co-founded Oban Microfinance earlier this year to provide access to a microfinance firm with low-interest rates in emerging economies, starting with Nigeria.

Microfinance generally refers to financial services used by lower-income individuals who may be excluded from or unable to access traditional banking options. Those using microfinance services often need smaller working capital loans.

Oban is using what Tengtrakool called “phone-collateralized lending.” Users on Oban’s app create a profile and link their bank account. The app assesses their phone, checking features like its camera quality, age and screen brightness. Tengtrakool said the process is similar to what happens when you trade in a phone at a store.

The app’s algorithm spits out an estimated value of the phone, usually between $50 to $200, which users can accept as a line of credit and withdraw money from Oban’s partner banks in Nigeria.

“Currently, people are paying 15% to 40% every month for interest on their loans. And now, because we can use their phone as collateral, they can pay from 3% to 5% every month,” Tengtrakool said. “Our end goal is to make microfinancing as equitable and accessible as possible."

Users have about a two-month period to pay back the loan. The longer they use Oban, the greater access to capital they earn, Tengtrakool said.

Built in a college dorm room

Roommates and fellow computer science majors Yitayew and Tengtrakool have been working on projects together over the last year. At first, it was experimenting with web3 and crypto, Tengtrakool said. But since Yitayew is from Ethiopia, the pair became interested in growing sectors in the African technology space.

“The biggest financial issues that we encountered were the predatory interest lending from the current microfinance market,” Tengtrakool said.

Nigeria was the perfect location to kick off their app launch because of the large microfinance market and high phone use, Tengtrakool said.

They hired Ifeoluwa Aigbiniode, an incoming freshman at Princeton University, to lead operations in Nigeria. She oversees a team of 10 Nigerians who go to markets and other populated areas to hand out flyers about Oban. Tengtrakool said they have about 6,000 users who will test the app after the beta launch on Sept. 1.

Oban — which is named after a range of hills in Nigeria — has raised $150,000 at a $5 million valuation, per Tengtrakool. The startup has been part of Harvard Innovation Labs and Z Fellows.

This upcoming semester the co-founders will balance schoolwork and clubs with working on Oban on as close to a full-time basis as possible. That work will hopefully include raising a seed round, Tengtrakool said. The funding will be used for incorporation fees, capital deployment and growing their team.

After the raise, the pair might take a semester off to devote more time to the fledgling company.

“I think for us especially, it’s cool to be building our own thing. It’s less of work and more something that we’re both passionate about,” Tengtrakool said.