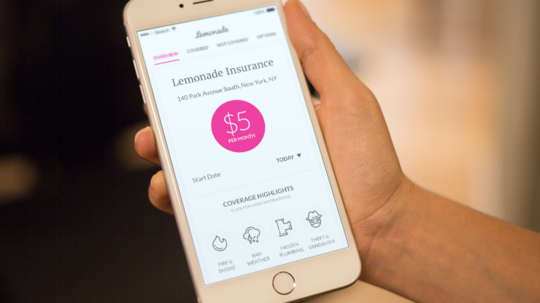

New York-based Lemonade Insurance, a company that uses behavioral science and artificial intelligence, launched in Massachusetts on Thursday.

The company was founded in 2015 by Shai Wininger and Daniel Schreiber as the world's first peer-to-peer insurance carrier and hired noted behavioral economist and Dan Ariely in 2016. According to Yael Wissner-Levy, vice president of communications at Lemonade, as its chief behavioral officer, Ariely was instrumental in designing systems using his research to mitigate risks and ensure to align the interests of both the insurers and the insured. Lemonade policies start from $5 and go up based on a number of factors like users' personal property.

The company's business model, messaging and product experience are based on Ariely's 15-year-old research on human behavior, specifically on honesty, to decrease fraud and increase trust among policyholders.

The company does this by putting Ariely's research to use when users file an insurance claim. Policyholders are asked to sign an honesty pledge at the start of the claims process that "gets them into the mindset of being truthful," Wissner-Levy wrote in an email.

Its target audience is first-time insurance buyers under the age of 35 and urban. According to Wissner-Levy, Lemonade has seen an increasing number of homeowners switching to Lemonade.

In April, Lemonade closed on a $300 million Series D round led by the SoftBank Group. At the time, co-founder and CEO Daniel Schreiber told TechCrunch that the company is on its way to clock in $100 million in revenue this year.

Lemonade claims it is different from other insurers in that it weaves a "giveback system" directly into the product by taking a fixed slice of users’ monthly payment as revenue and setting the rest aside for claims. The unclaimed premiums go to the user’s charity of choice at the end of the year. The company considers this system a core way to make insurance trusting and trustworthy.

"We like to think of it as enlightened self-interest," Wissner-Levy wrote.