When Patrick Kwete was running his first startup, he became interested in trading on the stock market from one of his investors, whose brother happened to work as a hedge fund manager.

As a trader, Kwete said he learned how to do quite well for himself, but he found that the various analysis tools he relied on to make investment decisions to be lacking. One of the problems was that none of the tools were clear about when they were right or wrong on predictions.

So after his first startup, which focused on digital health, didn’t work out, he took elements from a machine learning patent he was granted for the startup and used it as the foundation for a stock prediction app he co-founded with his wife, Xiaoxiao Jiang.

The app, called Market Sensei, has already found some traction, both domestically and abroad. For its Android app, it has nearly reached 5,000 downloads in the United States and more than 6,000 in China. While an iOS version is in development, the app is also accessible on its website at www.stockmarketsensei.net.

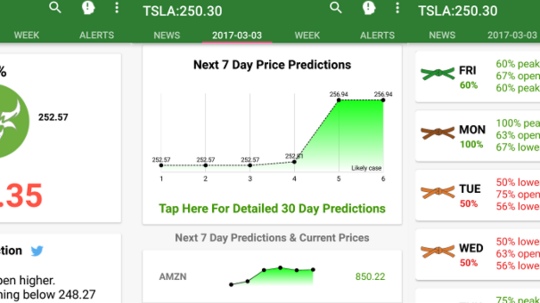

Here’s how it works: The app lets you look up companies by stock symbol and provides you predictions on how the stock price will perform for the day and the next seven days. It also lets you look at the accuracy rates for the app’s predictions from the last nine days in four categories: the opening price, the closing price, the high price and the low price.

For Kwete, there are a few things that make Market Sensei appealing: the transparency provided with the accuracy rates, a daily update of stock predictions based on machine learning algorithms that are fed years of historical stock data, a Tinder-like training game that tests your intuition on the performance of various stocks, and the lack of human bias.

Kwete said Market Sensei is made for active traders, as well as financial advisors who manage investment funds. The goal, he added, is to give traders full control over their investing decisions and allow them to take on bigger risks that wealth managers typically aren’t willing to make. “They’re not going to jump on opportunities that give you higher returns,” he said.

"They’re not going to jump on opportunities that give you higher returns."

While Market Sensei is free to download, users have to pay a monthly $20 subscription to unlock the up-to-date stock predictions, which is the main appeal of the app. Paid users also get notifications for investment opportunities and other things tied to the app’s daily analysis. (Free users only get to see historical predictions for dates preceding the most recent two weeks).

Over 100 people have already signed up for a subscription, Kwete said, making it profitable without taking any outside funding so far. And reception on the Google Play store has largely been positive, with the app receiving an average of four stars.

In the future, Kwete said he and Jiang plan to add more features, including the ability for users to integrate their brokerage accounts into the app and receive stock recommendations based on their trading history and other insights. After bootstrapping the app’s first year and a half of business, Kwete said he is now considering raising a Series A round and that he’s closing on two investors in the coming month.