The economic slowdown that experts predicted last year is here, and it’s having an impact on venture capital funding in Massachusetts, according to a new report.

Here's how venture capital funding, deal counts, exits and fundraising by firms has looked over the first half of 2023, according to the report by Pitchbook and the National Venture Capital Association (NVCA), as well as what's predicted for the second half of the year.

Funding and deals were down in the first half of 2023, but it’s not all bad news

In the first half of 2022, Massachusetts companies brought in $12.6 billion in venture funding. That number dropped to $8.3 billion in the first six months of this year, per new Pitchbook/NVCA data released today. That equates to a 34% decrease in venture capital funding.

The decline was precipitated by $9.6 billion raised by Massachusetts companies in the second half of 2022.

But it’s not all bad news. Massachusetts companies raised $3.9 billion in Q1 this year and $4.4 billion in Q2. That funding increase includes large rounds by companies like a $401 million mega-round by ElevateBio and Boston-based Nexamp Inc.’s recent $400 million financing.

It’s worth noting that deal count has also been declining, with Massachusetts companies securing 574 deals in the first half of 2022 compared to 377 thus far this year. During the same time period in 2021 the deal count was over 600.

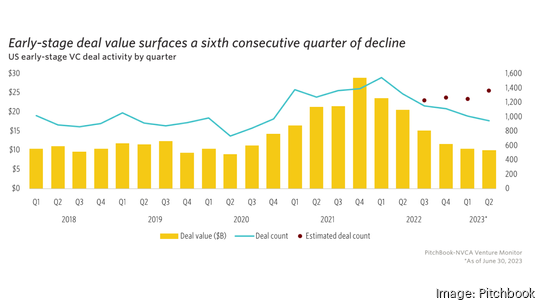

The report said this capital scarcity is hitting early-stage companies especially hard as VC firms focus on their existing, later-stage portfolio companies. At the seed stage, Pitchbook/NVCA found that quarterly deal value saw a 26.3% decline from the previous quarter.

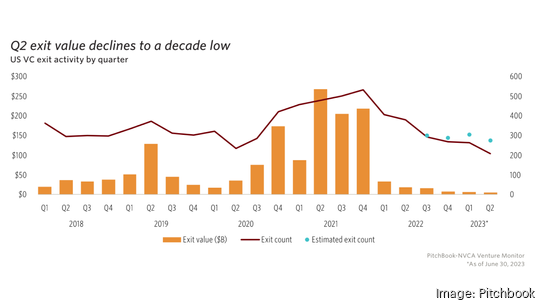

Dramatic drop in exits and exit value

Perhaps the biggest decline in the new data was in the number of exits recorded. The first half of 2021 saw 82 exits by Massachusetts companies. That went down to 62 exits during the same time in 2022 and 29 this year.

The exit value of Massachusetts companies was estimated at just $322.5 million in 2023. Pitchbook/NVCA found exit values hit $7.2 billion in the first six months of 2022 and $17.6 billion in 2021.

The report shows exit values per quarter back to 2014. In no quarter analyzed by Pitchbook and NVCA have exit values been nearly as low as in 2023.

Firms fundraising less, but retain dry powder

Boston tech venture capitalists previously said they were optimistic looking ahead to the rest of 2023 following the tech layoffs, bank collapses and economic downturn that marred the last year. Investors told the Business Journal they believe VC activity will start picking up as many funds need to start deployment.

For startup founders, it’s a welcome prediction, especially considering that fundraising by VC firms is declining in 2023. Massachusetts VC firms have raised around $4.4 billion in 2023. That puts firms slightly behind last year’s numbers, which reached $11 billion.

Nationally, Pitchbook/NVCA said the first half of 2023 is on track for the full-year fundraising figure to hit a six-year low.

Looking ahead, Pitchbook/NVCA said that the U.S. VC dry powder figure remains high at $279.8 billion. Pitchbook/NVCA said this number will likely remain elevated through the end of 2023.

“This dry powder is concentrated in mega-funds — those with $500 million or more in commitments — many of which have slowed their dealmaking activity in response to market volatility,” said the report.

Sign up for The Beat, BostInno’s free daily innovation newsletter from BostInno reporter Hannah Green. See past examples here.