This article is available in Spanish in partnership with El Planeta Media. Este informe está disponible en español, traducido por El Planeta Media.

Massachusetts is in the process of building an ecosystem by and for underrepresented founders, with a growing number of venture capital, networking and accelerator groups popping up to support Black- and Latino-led companies.

But the ecosystem is still in its early stages, and data on venture capital flow reflects this slow change. In 2022, Black startup founders in Massachusetts raised $110 million for their startups. That’s 0.56% of the total $19.5 billion that Massachusetts companies raised last year in venture capital, according to data from Crunchbase. In 2021, Black founders raised around .45% of the $35.7 billion in funding that went to Massachusetts companies.

Latino founders fared slightly better, raising 3.4% of the state’s venture capital total. In 2021, they brought in about 2%.

About 9.3% of the Massachusetts population identified as Black or African American on the most recent Census. Nearly 12.8% said they were Hispanic or Latino.

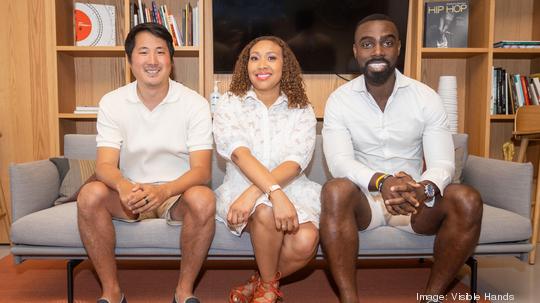

“A fraction of a percent is not good enough. A percent is not enough,” Daniel Acheampong, a co-founder and general partner at Visible Hands, told BostInno.

Even as funding to Massachusetts companies increased to record-breaking levels, the percentage of that funding going to Black and Latino founders remained largely stagnant.

Acheampong said we need to examine why the capital isn’t being deployed in a thoughtful and equitable way.

“There’s this work that needs to be done to challenge and question what patterns are being used to deploy capital…those patterns, or to some degree biases — how can we reevaluate them and, like any business, find ways to make it better,” he said.

Visible Hands is a venture capital firm that uses its programs, networks, and fund to support underrepresented founders. Acheampong said it’s in the DNA of Visible Hands to invest in talented yet overlooked founders and acknowledge biases. But, he said, this is an approach that can be learned.

“This is my point about all of us looking at patterns in which decisions are made, and just asking ourselves the question, ‘Is this right?’” Acheampong said.

Jason Allen, a lead portfolio manager of impact investments at Massachusetts Mutual Life Insurance Co., said they’re trying to make getting capital more accessible for undercapitalized founders and in undercapitalized regions. In February 2021, MassMutual launched its $50 million MM Catalyst Fund. Half of the funds will go toward Black-owned, founded or managed businesses across Massachusetts, and the other half is for technology companies based outside Boston.

More resources for Black, Latino founders

Allen said they’ve deployed about 30% of the capital to their portfolio companies. Allen said founders don’t need to know someone at MassMutual to pitch for funding. Founders can just apply through their website. During the review process, Allen said they use a “look twice” method. More than one person reviews each application to make sure they get a “fair shake,” he said.

“Looking at other things besides what exits they’ve had or what schools they went to,” Allen added.

Allen said there are more funds and groups popping up to support underrepresented founders in scaling their businesses. But, he said, we’re still in the early days of building a larger ecosystem of Black and Latino founders in Massachusetts.

“Once we get more companies seeded, we’ll hopefully have some great exits and that’ll create some angel groups that will focus on it, and that’ll continue to build and foster this ecosystem,” Allen said. “But it’ll take time.”

MassMutual is also using funds to diversify the VC ranks. It recently committed an additional $100 million to its First Fund Initiative, which supports Black, Latinx and Indigenous-led firms that invest in companies making a positive social impact and financial returns.

Allen said founders who are interested in applying for the MM Catalyst Fund should have a pitch deck prepared and know their business model. He said the team is very collaborative in working with promising founders through this process.

Visible Hands is also investing from its first fund of $10.5 million. Acheampong said he looks for founders to demonstrate a deep understanding of their industry, resourcefulness, self-direction and meaningful results.

Sign up for The Beat, BostInno’s free daily innovation newsletter. See past examples here.