Rockville’s X-Energy Reactor Co., LLC has raised an additional $80 million for its Series C round — which, in its second closing, now totals $235 million, the company said.

That makes the energy company’s funding round one of the largest in the region in 2023, an otherwise lackluster year for venture capital fundraising when compared with prior years. The company, which also goes by X-energy, announced the raise after its plans to go public via a merger with a special-purpose acquisition company were called off a month ago.

The $80 million investment comes from X-energy’s founder and Executive Chairman Kam Ghaffarian and from Ares Management Corp., the investment firm behind the blank-check company that, until a month ago, was planning to take X-energy public. Previous investors in the Series C round included Ontario Power Generation, Curtiss-Wright Corp., DL E&C and Doosan Enerbility. In total, X-energy has raised $645 million in financing to date, according to an investor presentation from September.

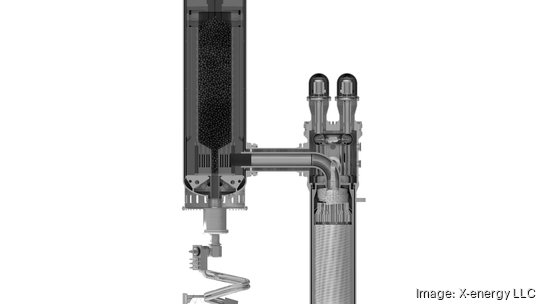

The company, founded in 2009, engineers small nuclear reactors and fuel technology. Its technology aims to “expand applications and markets for deployment of nuclear technology,” according to the firm. The investment will help X-energy continue to develop its Xe-100 tool, a high-temperature gas cooled reactor.

“X-energy’s differentiated and cost-effective technology is well-positioned to address the needs of power for the electric grid and generating heat for industrial applications,” David Kaplan, co-founder, director and partner of Ares Management Corp. said in a statement earlier this month announcing his company's investment in X-energy. “We remain confident in X-energy’s ability to create long-term, sustainable value for its stakeholders.”

We've reached out to X-energy for additional comment on how it will use the proceeds from the sale and will update this story if we receive more information.

When X-energy and Ares Management’s SPAC — dubbed Ares Acquisition Corp. — called off their merger, Ares Management said it still planned to make an investment in the energy company. At the time, it didn’t disclose the size.

Neither company paid a termination fee when the deal failed to go through. Instead, the two sides agreed that the timing was wrong given turbulence in the public markets and the poor reception companies that have gone public via SPAC mergers have received from investors.

“Both X-energy and AAC recognize the challenges presented by the current financial market environment and the opportunity for X-energy to continue forward as a private company,” X-energy's Ghaffarian said in a statement at the time.