Rockville’s MacroGenics Inc. just struck a deal with a major U.S. pharmaceutical company that could mean more than $1.7 billion for the local biotech.

MacroGenics (NASDAQ: MGNX) said Monday it has formed a collaboration agreement with Foster City, California-based Gilead Sciences Inc. (NASDAQ: GILD) — giving Gilead the green light to develop and exclusively license MacroGenics’ blood cancer treatment candidate, called MGD024.

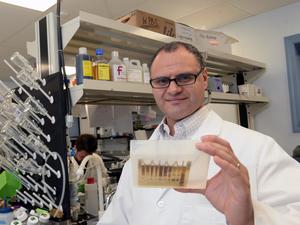

That molecule, now in early stages of development, was created using MacroGenics’ DART platform, which creates antibodies that can help destroy cancer cells, among other applications. And in this case, MGD024 aims to treat diseases including acute myeloid leukemia and myelodysplastic syndromes.

Working with Gilead “will accelerate our ability to drive further development of MGD024 to the potential benefit of people living with blood cancers,” Dr. Scott Koenig, president and CEO of MacroGenics, said in a statement Monday.

The deal also gives Gilead the green light to advance two other MacroGenics research programs.

Under the agreement, Gilead pays MacroGenics $60 million upfront, with potential for another $1.7 billion over time for development, regulatory and commercial milestones, as well as other fees. MacroGenics could also receive “tiered, double-digit royalties” on sales globally and a flat royalty on worldwide sales of the products under the two other research programs, the company said in its announcement. As MacroGenics handles the ongoing phase 1 clinical trial of MGD024, Gilead also has the option to license that program at certain points.

News of the deal Monday morning sent the company’s share price up more than 17% to a high of $4.14.

MacroGenics has been laying groundwork to focus on advancing MGD024; earlier this year, the company decided to stop developing a different molecule, called flotetuzumab, for that reason.

The deal with Gilead also comes a couple of months after MacroGenics announced a corporate restructuring that involved cutting its workforce by 15% and closing two of its satellite facilities: a small manufacturing site in Rockville and a research facility in Brisbane, California. Those decisions were intended “to extend our cash runway and put MacroGenics in a stronger position to execute on our prioritized programs,” Koenig said in a statement in August. MacroGenics closed 2021 with 427 full-time employees, according to Securities and Exchange Commission filings.

The business ended June with $133.7 million in cash, cash equivalents and marketable securities, plus $34.5 million in payments it received from collaboration partners in July. In the second quarter of 2022, MacroGenics’ revenue reached $26 million — including $4.7 million from sales of breast cancer treatment Margenza, its first drug approval scored in December 2020 — compared to $30.8 million in revenue for the quarter of 2021, per SEC filings. The company also suffered a net loss of $41.3 million in the second quarter of this year, up from $39.9 million in the second quarter of last year.

MacroGenics also stands to rake in more money from its collaborations, which already represent the majority of its revenue. Teplizumab, a treatment candidate for Type 1 diabetes that MacroGenics sold to Provention Bio Inc. in 2018, should receive the Food and Drug Administration’s review by Nov. 17 — and, if approved, would mean royalties on net sales including $60 million upon a U.S. approval for the local company.

The Maryland biotech also received $30 million in milestone payments after licensing retifanlimab to Incyte Corp., and could receive more if the drug, now in clinical trials, is later approved.

MacroGenics separately expects to start a phase 2/3 study by year’s end of a candidate in patients with a form of advanced prostate cancer, and has another candidate in early-stage studies for colorectal cancer, nonsmall cell lung cancer, metastatic prostate cancer and melanoma. In July, the company had closed a phase 2 study evaluating a treatment for patients with a cancer of the head and neck following seven deaths potentially associated with hemorrhagic events.