Greater Washington could get yet another public company soon in what’s been a banner year for initial public offerings, courtesy an energy storage spinoff company based in Arlington.

Fluence Energy Inc. proposes to sell up to 35.65 million shares of common stock, including those set aside for underwriters, at an IPO price ranging from $21 to $24 apiece, according to a Securities and Exchange Commission report it filed Tuesday.

It said it could raise a maximum of $855.6 million if all the shares trade at the high end of the IPO price range. It expects to retain anywhere from $650.9 million to $750 million, depending on underwriter purchases, in net proceeds, which it ultimately plans to funnel toward repaying outstanding debts, including to AES (NYSE: AES) and Siemens, among other general corporate purposes.

The company, which had yet to establish a date for its IPO, aims to trade on the Nasdaq Global Market under the ticker symbol, “FLNC.”

Fluence develops software and digital products that help boost the amount of battery energy that can be stored to help relieve pressure on the electric grid. It was founded in 2018 as a joint venture between AES Corp. of Arlington and New York’s Siemens AG called Fluence Energy LLC, which the resulting public company plans to essentially acquire. Backed by a $125 million investment last year from QFH, which is an affiliate of the Qatar Investment Authority, Fluence Energy said it’s deployed 1 gigawatt’s worth of energy storage assets and has an estimated $1.3 billion-plus worth of contract backlogs as of Sept. 30, per its SEC filings.

In all, the company projects its total revenue for fiscal 2021, which ended Sept. 30, will lie between $650 million and $699 million, up from $561.3 million for fiscal 2020. It does expect a dip in its 2021 fourth-quarter revenue — expected to be between $158 million and $207 million, compared with $239.5 million in the same period in fiscal 2020 — due to Covid-related closures of its construction sites and shipping delays of its energy storage products.

As a result, it forecasts a net loss ranging from $158 million to $169 million for fiscal 2021, significantly larger than its $46.7 million net loss the previous fiscal year. Much of that stems from the fourth quarter, where a $1.1 million net loss in 2020 could skyrocket to $84 million on up to $95 million in this most recent quarter.

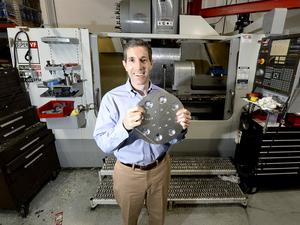

Former AES executive Manuel Perez Dubuc leads Fluence Energy as its CEO while Dennis Fehr, a former finance executive at Siemens, serves as its chief financial officer. Its C-suite is rounded out by Seyed Madaeni as chief digital officer, Rebecca Boll as chief product officer and Carol Couch as chief supply chain and manufacturing officer.

The IPO should result in some money flowing toward AES, which generates and distributes power to several countries. AES currently owns about 43.2% of Fluence, while Siemens owns another 43.2% and QFH owns 13.6% through its investment last year.