Arlington’s Vemo Education has made its first acquisition.

The 6-year-old company, which offers college students income-share agreements as an alternative to traditional loans to pay for their education, has scooped up Boston ed-tech startup Edmit, Vemo CEO and co-founder Tonio DeSorrento told us Wednesday. Terms of the transaction were not disclosed.

Edmit works with high schools and financial institutions to provide students and their families planning tools as they look to make decisions about college and how they’ll cover the costs. Together, the companies plan to bring to market new products focused on de-risking students’ and families’ investment in higher education, as well as driving a return on that investment for students.

That means simplifying financial aid packages for colleges and students, helping schools demonstrate their ROI to students, and providing risk protection for student loan borrowers, Edmit co-founder and CEO Nick Ducoff said in an email. They’re developing “a couple of new products as we speak,” he added. The partners declined to share specifics but one or two new initiatives could go live in the coming weeks, DeSorrento said.

DeSorrento declined to disclose company revenue or projections for this year, but said he expects Vemo to grow revenue as a result of the acquisition.

The business also intends to grow its headcount. Vemo counted less than 50 employees before the agreement with a target of nearly 60 by year’s end, and is hiring for education technology product and analytics positions, DeSorrento said. The local company also plans to maintain Edmit’s staff, which has 13 employees currently and will hire more this year, Ducoff said. His title will be co-founder and president of Edmit, which will keep its name and operate independently under the Vemo umbrella.

“We’re not going to be interfering with Edmit’s editorial independence. This acquisition will have no impact on its content or the advice it shares to students and parents,” DeSorrento said in an interview Wednesday. “I think that could be a thing people worry about, but it wouldn’t work, this whole thing doesn’t work if we don’t both speak the truth to our constituency: Edmit needs to be speaking the truth to students and parents, coaching them to ask for value from colleges; we need to be coaching colleges to deliver that value.”

This deal — and the prospect of more

Vemo’s model offers a different way to pay for higher education, in which a student borrows money from the university and agrees to pay a percentage of his or her income following graduation for a period of time. It’s not a new financing method, but has gained traction in recent years as part of universities’ financial aid and enrollment strategies.

Schools hire Vemo to implement and execute the agreements. The company works with a total of 70 academic institutions, including colleges, coding boot camps and other types of programs to make that happen. For its part, Edmit comes in early in the college decision-making process, and reports that more than 1.5 million families have used its financial planning tools.

The deal came together after Ducoff approached DeSorrento about the prospect of teaming up. The two had known each other for years and, though the businesses “face different directions," DeSorrento said, joining forces made sense, particularly because they have a common set of data.

“At our core, we’re here to help colleges understand the return that students get on their investment and improve it — understand it, prioritize it, do better at it. Edmit coaches consumers, students and parents, to look for that and ask for it from schools,” DeSorrento said, adding: “To me, those things actually fit together very well.”

Vemo wasn’t specifically looking to acquire a company, but large ventures in the higher education space “often have to grow through acquisition, because colleges are very brand-conscious and tend to buy things they’ve heard of, and they’re pretty loyal customers ... so I had always thought our future probably includes having to acquire other companies so that we can serve schools more broadly,” DeSorrento said.

And DeSorrento doesn't expect Edmit to be the company's last acquisition. “We’re under no mandate to go buy more businesses, but I think we’re open to that because we want to be a really great partner to our colleges and colleges need more than what we sell," he said.

The bigger picture for Vemo

Going forward, Vemo hopes to see its own business pick up as the coronavirus crisis subsides. Interest for the company’s services has been high, but college management teams with limited bandwidth saw resources further diminish during Covid. Now, DeSorrento said, “we expect those management teams are going to turn to their futures, as opposed to dealing with present crises.”

Those crises have widened disparities in application rates, with first-generation applicants and students from low-income households less likely to seek admission to college, according to both companies. They plan to work to address those access and affordability issues by making the process more transparent for students and families, and positioning colleges to orient the cost of tuition to graduates’ jobs.

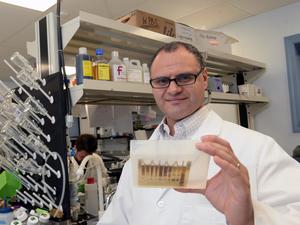

DeSorrento — a Washington Business Journal Veterans in Business Awards honoree of 2020 — co-founded Vemo Education in 2015 after serving in the military and then working as a deputy general counsel for student loan refinancing company SoFi. In its inaugural year, Vemo, — a 2017 Startup to Watch — raised $7.4 million in seed funding, and had raised $35.73 million as of April 2020, according to PitchBook.

But the company hasn’t disclosed all of the funding it has raised, DeSorrento said, declining to share that number. To date, Edmit has raised $3 million, according to Ducoff.

Ducoff started Edmit in fall 2017, after serving as vice president for new ventures at Northeastern University. He and co-founder Sabrina Manville, who worked at Southern New Hampshire University, saw at their schools “that students and their families had a lot of questions about the cost of college, how they were going to pay for it, and what jobs and salaries they could expect after graduating,” he said in an email. “We saw the need for a market-based solution to help students better estimate their cost, and outcomes, so they and their families could find the school with the best return on investment for them,” he added.

Income-share agreements, or ISAs, have received their share of criticism, with increasing attention in 2019 when the Trump Administration considered implementing an ISA program with the Department of Education. Critics claim ISA contracts can be predatory and lack proper oversight — and Vemo received some of that censure, when public interest groups in spring 2020 wrote a letter to the Federal Trade Commission.

“When new financial models emerge, they draw reasonable concern from consumer advocates,” DeSorrento told us in July 2020. “Vemo has long advocated for strong protections for student consumers and a legal framework to establish guardrails for colleges and other education providers when offering income share agreements. We understand that the nuances of emerging — and often unfamiliar — approaches like ISAs must be communicated as clearly and transparently as possible to students and families.”