Aziyo Biologics Inc. has set the terms of its initial public offering.

The Silver Spring regenerative medicine company, which first filed in mid-September to trade on the Nasdaq stock exchange, expects to issue 2.94 million shares of common stock priced at an estimated $16 to $18 each, according to a Securities and Exchange Commission document filed Wednesday. That positions Aziyo to raise between $47.1 million and $52.9 million, with a proposed maximum aggregate offering price of $60.88 million if the underwriters exercise their option to purchase additional shares.

The company, set to trade under ticker symbol AZYO, has not yet disclosed an IPO date.

Aziyo said it expects that about $7.9 million would fund new sales hires and an expanded marketing program, while roughly $10.6 million would support product development and clinical research activities. The rest would be used for working capital and other general purposes. “We may also use a portion of the net proceeds from this offering to acquire, in-license or invest in products, technologies or businesses that are complementary to our business,” the filing reads.

The news comes just a couple of days after Aziyo tapped Matthew Ferguson — most recently chief financial officer of Pittsburgh, Pennsylvania-based Bossa Nova Robotics — as its new CFO, effective immediately. His resume also includes stints at a handful of California companies, including cardiovascular medical device firm Avinger Inc. and biotech Tethys Bioscience Inc. He’s just one new face at Aziyo, which last week also added a new members to its board of directors: Maybelle Jordan, vice president of business development for New Jersey’s Biomerix Corp., and Brigid Makes, former senior vice president and CFO of California’s Miramar Labs Inc.

Aziyo moves toward its IPO months after President and CEO Ron Lloyd told the Washington Business Journal the business would look to go public in fall 2020.

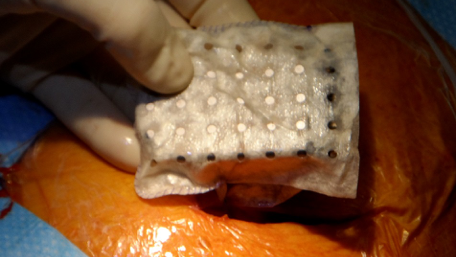

Aziyo sells to hospitals, providing its human tissue products — which are implanted into the body and regenerate tissue to reduce complications that come with surgery — to surgeons. It also has a business-to-business model, where it develops and manufactures the products, then lets commercial partners handle the sales. Its products include CanGaroo, used for patients getting pacemakers and defibrillators, and SimpliDerm, a material used for reconstructive surgery, among others.

The now 5-year-old company has raised about $45 million to date, largely from HighCape Partners and Deerfield Management Co., including a recent $5 million in equity funding. The business had about 150 employees at the end of June, according to its SEC filings.

Aziyo took in $42.9 million in total net sales last year, a 10% bump from the prior year, though it experienced relatively flat net losses of nearly $12 million. For the first six months of this year, the company saw a slight dip in revenue to $18.4 million and significantly wider losses from the same period last year, from $6.1 million in 2019 to $9.7 million in 2020.

Underwriters for the offering include Piper Sandler & Co., Cowen and Co. LLC, Cantor Fitzgerald & Co. and Truist Securities Inc.

Aziyo spun out of nonprofit tissue processing company Tissue Banks International in November 2015. Then it acquired Roswell, Georgia-based CorMatrix Cardiovascular Inc. in May 2017. That acquisition added five commercial products, 50 employees, two executives and a new technology platform to Aziyo.

The Montgomery County company follows two other local biotechs that debuted recently in the publicly traded arena: Gaithersburg’s Viela Bio Inc. (NASDAQ: VIE) and Beltsville’s NextCure Inc. (NASDAQ: NXTC). It marks the first Greater Washington biotech exit this year, and comes after other D.C.-area companies — Reston telemedicine firm SOC Telemed and Silver Spring documentary streaming service CuriosityStream among them — pursued mergers with blank-check companies during 2020 to go public. Meanwhile, other local biotechs sit on deck, including Rockville vaccine maker Immunomic Therapeutics Inc., which revealed its intention to IPO next year.