Silver Spring’s Aziyo Biologics Inc. has filed to go public.

The commercial-stage regenerative medicine company will look to trade publicly on the Nasdaq Global Market under ticker symbol AZYO, and aims to raise $57.5 million with this offering, according to a preliminary prospectus filed Monday evening. The company did not disclose an estimated share price or date for the public offering.

The proceeds from this offering would be used to hire more sales staff and expand marketing, fund product development and clinical research activities and support other general purposes, Aziyo reported in its filing. “We may also use a portion of the net proceeds from this offering to acquire, in-license or invest in products, technologies or businesses that are complementary to our business,” it reads.

We've reached out to the company for comment and will update this story as we hear back.

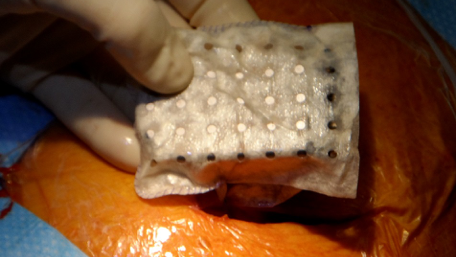

It comes about eight months after Aziyo President and CEO Ron Lloyd told the Washington Business Journal the business would target a fall 2020 IPO. The Montgomery County company sells to hospitals, providing its human tissue products — which are implanted into the body and regenerate tissue to reduce complications that come with surgery — to surgeons. It also has a business-to-business model, where it develops and manufactures the products, then hands the commercialization off to partners.

Aziyo reported in its Securities and Exchange Commission filing that total net sales increased 10% from $39 million in 2018 to $42.9 million in 2019, and gross margins improved from 41% in 2018 to 46% in 2019. The company also experienced a net loss of $11.6 million in 2018 and of $11.9 million in 2019. And while total net sales decreased from $19.7 million in the first six months of 2019 to $18.4 million in the first six months of 2020, Aziyo reported gross margins improved from 47% in the first half of 2019 to 49% in the first half of 2020. It also took a net loss of $6.1 million in the first half of 2019, less than its net loss of $9.7 million in the first half of 2020.

Underwriters for the offering include Piper Sandler & Co., Cowen and Co. LLC, Cantor Fitzgerald & Co. and Truist Securities Inc.

Aziyo is just the latest Greater Washington company to go public, following two biotechs — Gaithersburg’s Viela Bio Inc. (NASDAQ: VIE) and Beltsville’s NextCure Inc. (NASDAQ: NXTC) — and, most recently, D.C.’s Ibex Ltd., which provides outsourced customer service products and services. Others, such as Reston telemedicine firm SOC Telemed and Silver Spring documentary streaming service CuriosityStream, have taken the route of merging with a blank-check company. And more local companies sit on deck, including Rockville vaccine maker Immunomic Therapeutics Inc., which made public its intention to IPO next year.

The 5-year-old Aziyo has raised about $45 million to date, largely from HighCape Partners and Deerfield Management Co., including a $3 million bridge round at the end of 2019 and $10 million in 2018. The business was not yet profitable at the start of this year, but close to breaking even with earnings before interest, tax, depreciation and amortization (EBITDA), Lloyd had said. Aziyo has also indicated in an SEC filing it has raised $5 million in equity funding.

Aziyo has had an active few years in which it not only raised millions in capital, but launched products in hospitals across the country and teamed up with industry giants such as medical device behemoths Medtronic (NYSE: MDT) and Boston Scientific Corp. (NYSE: BSX). It also executed an expansion in 2019 with a hiring spree for sales reps, and efforts to speed up pipeline development and product commercialization. Aziyo took in more than $40 million in revenue last year. Aziyo’s products include CanGaroo, used for patients getting pacemakers and defibrillators, SimpliDerm, a material used for reconstructive surgery, and a host of others. For all of its products, the company must first earn Food and Drug Administration approval, either through its medical device or biologic divisions.

Aziyo spun out of nonprofit tissue processing company Tissue Banks International in November 2015. Then Aziyo acquired Roswell, Georgia-based CorMatrix Cardiovascular Inc. in May 2017, a deal funded by a $12 million raise. That acquisition added five commercial products, 50 employees, two executives and a new technology platform to Aziyo, the WBJ reported at the time.

Lloyd joined Aziyo in June 2018, after posts at Mallinckrodt Pharmaceuticals (NYSE: MNK), where he led its hospital therapies business, Baxter International Inc. (NYSE: BAX), where he ran its regenerative medicine business unit, and Abbott Laboratories (NYSE: ABT).