Xometry Inc. (NASDAQ: XMTR) has inked a deal to snap up a New York digital marketing company for $300 million, a move that stands to rapidly expand the newly public manufacturing firm and speed up its path to profitability.

The Derwood company, whose on-demand platform connects engineers and product designers with manufacturers, said Wednesday it will acquire Thomas Publishing Co., a product sourcing and marketing platform, for $198.5 million in cash and $101.5 million in common stock.

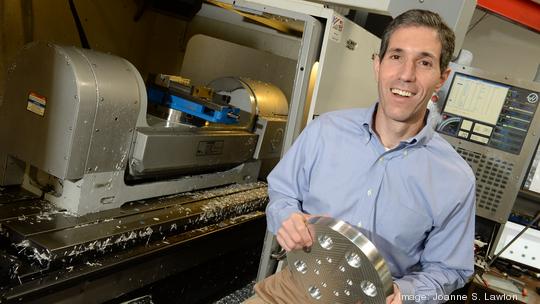

The transaction, expected to close Friday, would make Thomas a wholly owned subsidiary of Xometry. And it would do a few things for the local player, which went public at the end of June. That list includes speeding up the growth of its marketplace, improving its pricing with greater scale and data, broadening its buyer and seller base, rolling out new services and products, and ballooning revenue, Xometry co-founder and CEO Randy Altschuler said on a company conference call early Wednesday.

Thomas generated $67 million in revenue and $57 million in gross profit for the 12 months ending Sept. 30. During that time, Xometry reported $189 million in revenue and $46 million in gross profit, continuing its year-over-year revenue growth from $38.4 million in 2018 to $80.2 million in 2019 to $141 million in 2020. Joining forces promises new revenue streams for Xometry, positioning the business to expand its seller services revenue by nearly 10 times, better its margins by 20% to 30% and reach a full year of profitability in 2023, according to the company.

The acquisition also positions the business to bolster its customer base, which in the third quarter of 2021 comprised 26,187 buyers, up 61% year over year, including about 30% of the Fortune 500. It also served 1,410 sellers in 2020, up 82% year over year from 774 in 2019.

Thomas brings to the table 1.3 million users — from Johnson & Johnson to Lockheed Martin to NASA — and 500,000 sellers in North America. And because Thomas doesn’t drive revenue from its user activity, “this provides a tremendous opportunity for Xometry marketplace to be the monetization engine on the Thomas platform,” Altschuler said on Wednesday’s call. Xometry’s buyers generated about $180 million in revenue over the last year, “so it’s easy to see why we’re so excited by this opportunity to provide Thomas’s 1.3 million users access to our platform,” he said.

“On the seller services front,” he added, “there’s significant room to cross-sell Xometry’s supplies and financial services products into Thomas’s 500,000-plus sellers, and offer Thomas’s suite and services to our growing base of sellers.”

That’s also important, he said, because while Xometry’s sellers services is growing fast, it still makes up less than 5% of total revenue, while the Thomas platform generated $67 million in revenue from its seller base over the past year.

Following this deal, Xometry said it’s poised to attack a $2.4 trillion total addressable market.

Xometry’s stock was up 4.5% to $46.74 per share early afternoon Wednesday.

This acquisition isn’t Xometry’s first. The company purchased rival tech startup MakeTime in July 2018 and Munich-based Shift in December 2019. In November, Xometry acquired two more companies: Los Angeles-based FactoryFour for $6.3 million, to help manufacturers in Xometry’s marketplace improve lead times with its software; and Brookhaven, Georgia-based Big Blue Saw for $2.5 million, to grow its water jet and laser cutting capabilities.

Altschuler told us in June the business may use some proceeds from its initial public offering to add more products or technologies, while keeping an eye out for great management and talent as a possible M&A target. We have reached out for more about the company’s acquisition strategy going forward and will update this post as we hear back.

Altschuler launched Xometry in 2013 with co-founder Laurence Zuriff. Over the summer, the company executed a roughly $300 million IPO — raising much more than originally planned — to grow further within the manufacturing market. That came after a $75 million funding round in 2020.