Over the last few decades, Greater Washington and its venture and tech communities have seen ups and downs — and a whole lot of change.

And as 2020 continues to unfold in new and unpredictable ways, I thought it was worth taking a look back at some of the startups that helped contribute to the region's current tech and startup ecosystem. And it was not an easy task. There were many companies that did not make this list but that have a place in the DNA of the region.

The original job-posting giant CareerBuilder LLC, the slow-motion collapse of energy storage company GridPoint Inc., the double bottom-line mission of EverFi Inc. — they were or remain a big part of what makes this region tick.

And they all began as startups, ventures not guaranteed to work and with big risks.

Here is my attempt to narrow it down to the top 10. The criteria was a bit soft, a mixture of what kind of impact they had on the perception of the region, who from that company ended up forming other ventures, and in part what became of that company later.

Blackboard Inc.: This noteworthy D.C. online learning company — founded in 1997— not only carved out an educational technology space locally, but showed that online education technology itself is big business. The company, grown in part with local venture dollars from Novak Biddle Venture Partners, The Carlyle Group and AOL Inc., became the dominant player in the online learning space. It went public in 2004 and ultimately was acquired by private equity Providence Equity Partners in a $1.64 billion deal in 2011.

Its founder, Michael Chasen, continues to start new companies, including his most recent ed-tech venture, ClassEDU, built on the Zoom platform. Other Blackboard execs have gone on to found other noteworthy startups, including its former chief corporate officer, Andrew Rosen, who founded ed-tech firm Interfolio Inc. in 2015.

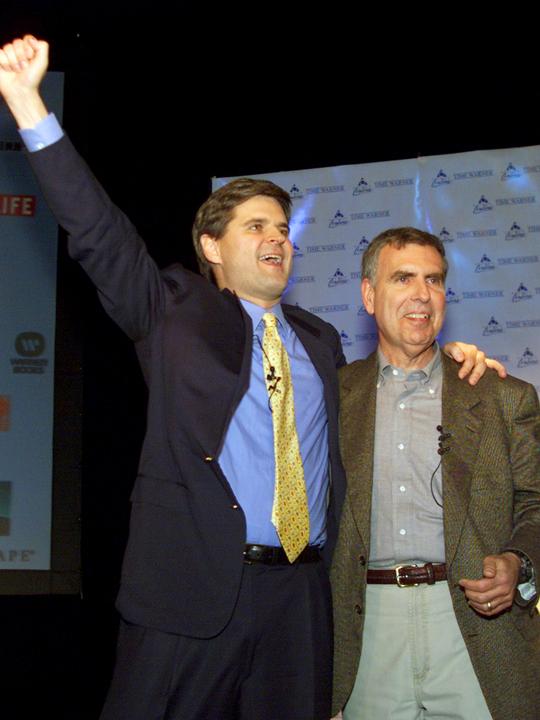

AOL Inc.: No list would be complete without AOL, which, at its peak, reached an eye-popping market cap of $200 billion, although a disastrous 2000 merger with Time Warner Inc. and a series of missed opportunities left the company to be sold for $4.4 billion to Verizon in 2015. But the onetime Dulles-based company, which employed 12,000 locally at the time of the merger, also minted about 4,000 millionaires as it grew rapidly in the 1990s. Its alumni network includes Lisa Hook, a former AOL president in broadband and premium services who went on to lead Sterling-based Neustar Inc., taking it private in 2017 in a $2.9 billion deal before departing the company in 2018. AOL's former digital content chief, Jim Bankoff, is now CEO of Vox Media Inc., valued at more than $1 billion. Tim O'Shaughnessy was a former AOL product manager, and he went on to found LivingSocial Inc. and is now head of Graham Holdings Co.

AOL co-founder Steve Case became a billionaire, and started up local venture firm Revolution. Ted Leonsis, also an AOL alum, now owns several sports teams under the auspices of Monumental Sports & Entertainment. AOL also for a time served as an acquirer locally, purchasing Millennial Media for $238 million in 2015, among others.

LivingSocial Inc.: Founded as Hungry Machine in 2007, LivingSocial had the buzz and the image of a bonafide Silicon Valley consumer company — but in D.C. By 2011, the company had raised more than $800 million in funding and generated hundreds of millions in revenue (but also massive losses). It counted Amazon.com Inc. among its investors. But it was perhaps its slow-motion collapse that garnered more of the spotlight, as the company shrank from thousands of employees to a few hundred, before eventually laying off most of the company. It ultimately sold itself to Groupon Inc. for no money in 2016.

Its founder and early leader, Tim O'Shaughnessy, ended up becoming the CEO of Graham Holdings Co.

MicroStrategy Inc: Founded in 1989 by Michael Saylor and Sanju Bansal, the Tysons company went public in 1998 and grew rapidly, until the Securities and Exchange Commission brought fraud charges against the company and its top execs in 2000 for overstating revenue and earnings. The charges were ultimately settled. It also spun out Alarm.com Inc., selling it to ABS Capital Partners for $27.7 million in 2009, although the company now trades publicly.

MicroStrategy continues to make waves, whether it's for Saylor’s initial adamance not to close offices during the early days of the Covid-19 pandemic, or his recent decision to put about $250 million of the company’s money into Bitcoin.

Cvent Inc.: The event management software firm founded and still run by Reggie Aggarwal has seen its ups and downs, but survived a near fatal flameout during the dotcom bust to go public in 2013, after it had received $136 million in funding in 2011. It was then acquired by Vista Equity Partners for $1.65 billion in 2016, and has grown to recently employ more than 4,000 people.

It has also become a local acquirer, too, purchasing D.C. event software company Social Tables for north of $100 million in October 2018. But the spread of Covid-19 — which halted many in-person events — hit the company hard, forcing the firm in May to lay off or furlough 10% of its global workforce, and about 7% of its roughly 1,200 staff in the region.

UUnet Technologies Inc.: Northern Virginia did not become a center for the internet through AOL alone. Part of the reason why so much of the internet's traffic and data runs through the region is thanks to Fairfax-based UUNet Technologies Inc,. which was founded in 1987 and was able to connect businesses to the internet as one of the first commercial internet providers. It ultimately sold in 1996 to MFS Communications Co. in a $2 billion deal, and was subsequently bought by WorldCom Inc. and then ultimately by Verizon Communications Inc.

New Enterprise Associates helped fund UUnet, and the exec on the deal, Peter Barris, ultimately became general managing partner of the venture firm in 1999, growing it to more than $20 billion in assets. Mike O’Dell, former CTO at UUNET, became a venture partner at NEA.

Sourcefire Inc.: The Columbia, Maryland-based cybersecurity firm was founded in 2011 by Martin Roesch, and was funded in part by New Enterprise Associates. It grew quickly and went public in 2007. Over the ensuing years it rejected several purchase offers, ultimately growing to about $223 million in revenue in 2012 and then accepting a $2.7 billion purchase offer from Cisco Systems Inc. in 2013.

The purchase helped cement Greater Washington as a focal point for cybersecurity talent and startups. Sourcefire alums have formed the backbones of other companies, while former CEO E. Wayne Jackson is now the CEO of Sonatype Inc.

The BET Networks: The parent company of the Black Entertainment Television network, founded in D.C. in 1979, not only helped revolutionize television, but it did so from the nation’s capital. It not only had offices but studios on its campus in Northeast, and was ultimately purchased by Viacom in 2000 for $2.3 billion in stock — and announced it was relocating its HQ to New York in 2017.

BET co-founder Sheila Johnson was the first Black woman to reach $1 billion in net worth, and became the founder and CEO of Salamander Hotels and Resorts. She's also team president and managing partner of the Washington Mystics, and has a stake in other local teams as a partner in Monumental Sports & Entertainment. Fellow co-founder Bob Johnson is still involved in a big portfolio of companies, including RLJ Entertainment Inc., which keeps him in the media space as the operator of the Urban Movie Channel and Acorn TV properties.

WebMethods Inc.: This Fairfax software company was founded in 1996 by Phillip and Caren Merrick to allow software applications to communicate with each other, doing what later became “web services.” The company saw rapid growth and went public in 2000, first boosting its initial public offering price from $13 per share to $35 per share based on strong investor interest. It saw its stock shoot up even more and closed that first day at a stunning $212.62 per share, making it one of the most successful IPOs in history.

It was named the fastest-growing software company in North America by Deloitte in 2002, and was ultimately acquired in 2007 by Software AG for $546 million. Phillip Merrick was recently CEO of email firm SparkPost before moving over to be CEO of Frederick, Maryland-based cloud security company Fugue Inc. Caren Merrick is currently the CEO of VA Ready, which aims to retrain and equip out of work Virginians.

Discovery Inc.: The Silver Spring company (it has been slow-walking a corporate shift to New York for years now) was important for what it was not — a software or government-related business that called Greater Washington home. Its array of channels created a miniature ecosystem for content creators and independent studio workers that would not have been possible otherwise.

And while its corporate headquarters once counted more than 1,300 employees, it also served as the focal point for countless independent contractors as well. Founder John Hendricks went on to create documentary streaming service CuriosityStream Inc., which is going public by merging with a blank-check company.