Motley Fool Ventures, the venture capital arm of financial advisory firm The Motley Fool, has raised $102 million for its second fund — and it's still going strong with fundraising.

Eventually, it’s targeting $300 million for its final close — an amount that would be double the size of its first fund.

The initial close of Motley Fool Ventures II is made up of $94 million from a “feeder fund,” which is made up of mostly individual investors and another $8 million from other investors. Around 300 new investors across 30 states and D.C. — mostly from the Motley Fool’s audience — took part in the initial raise over four months, the company said.

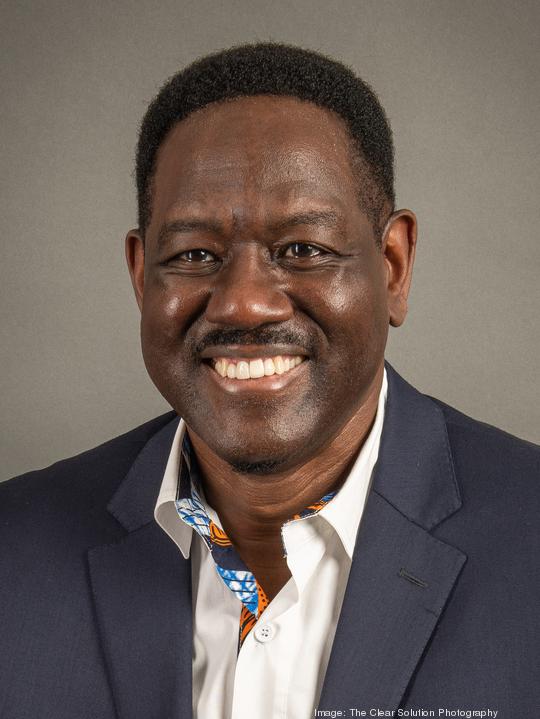

Now, it's on the road to collect more, with the potential of exceeding even the higher-end expectations — “$300 million is not a hard cap, and we anticipate the [remaining] $198 million will come from professional LPs that invest in emerging managers,” said Ollen Douglass, managing partner at Motley Fool Ventures since 2018.

While Alexandria-based MFV hasn’t made an investment from Fund II yet, it’s “actively evaluating several opportunities,” Douglass said. When it does begin deploying, those dollars will go toward companies that are transforming industries through software and tech solutions, so fintech, property tech and health tech companies, for example, the company said.

Much like with MFV’s first fund — which launched nearly four years ago and ultimately raised $150 million, surpassing its $100 million goal — investments will go toward earlier-stage companies, primarily those raising Series A and Series B investments.

D.C. flower delivery retailer UrbanStems Inc., Arlington meal delivery service Territory Foods, McLean health staffing firm ShiftMed and D.C. auto refinancing firm Caribou Financial Inc., formerly MotoRefi, were among the local startups that benefited from Motley Fool Venture’s first fund. About one-third of that pool went toward companies in Greater Washington, Douglass said, adding: “That group is delivering strong returns.”

He expects to bring more local companies into its portfolio, at about 25 active investments, in the future, Douglass said. “We think we’re only scratching the surface of great companies in the region,” he said.

It's also put its money toward inclusive investments in what's largely a white male-dominated field of venture capital, where only 2% of funds go to back Black or Latino founders. Last year, it funneled $5 million from its first fund into 14 other funds that were “directly addressing underrepresentation in VC” and were, themselves, staffed by combined leadership that was 54% women and 71% ethnically diverse. Its recipients included D.C.-based Zeal Capital Partners, run by founder Nasir Qadree, and Alexandria-based Ardent Venture Partners, run by partners Phil Bronner and Phil Herget.

None of that is to mean MFV is only looking to invest locally, however. Around 80% of its investments with the new fund will be limited to the U.S., leaving plenty of space to look in other countries. The company will be targeting what it referred to as “emerging markets,” and investing alongside VCs that have experience, though it didn’t specify any regions or countries on its radar.

The fund will be deployed in about 30 to 40 investments over the next five years, similar to Motley Fool Ventures' pace with its first fund. The difference this time, though: With a target size significantly larger than that of Fund I, its managers "will be writing larger checks, on average,” said Douglass, a Washington Business Journal Diversity in Business Awards honoree in 2019.