Sirnaomics Inc. just raised a whopping $105 million — ahead of a planned initial public offering.

The Gaithersburg biopharmaceutical company said late Thursday the Series D funding will support continued development of its treatments for cancers, metabolic and fibrosis diseases and viral infections. Existing investor Rotating Boulder Fund, and new investors Walvax Biotechnology Co. Ltd. and Sunshine Riverhead Capital, led the round. Sangel Capital, Longmen Capital, HongTao Capital and Alpha Win Capital also participated.

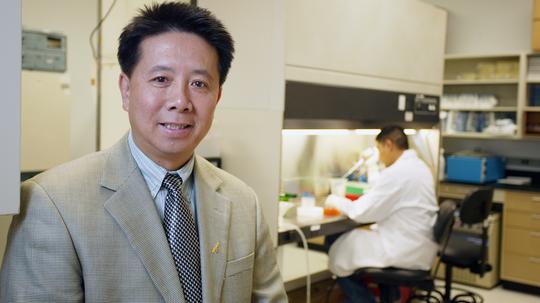

“This type of investor base will not only strengthen our financial foundation, but also brings tremendous experience and expertise to Sirnaomics as it enters the next phase of growth and prepares for an initial public offering in near future,” said Patrick Lu, president and CEO of Sirnaomics, in a statement.

The company did not provide further details about the prospect of an IPO. We have reached out for comment and will update this post when we hear back.

The round, which was oversubscribed, is “further validation that RNAi therapeutics are attracting a great deal of interest from the investment community and is fueled by innovative targeted technologies and very impressive clinical results,” said Lu, also the company’s founder.

Those RNAi therapeutics, as they’re called, use RNA interference technology to shut down disease-causing genes. And they’re the clinical-stage biopharma’s ticket to an IPO.

That’s because Sirnaomics is “the only biopharma venture conducting innovative R&D and clinical development in the field of RNAi therapeutics in both the U.S. and China, the two largest markets for cancer and fibrosis disease treatments,” said Donald Dai, managing partner of Rotating Boulder Fund, in a statement. “The management team has a well-balanced skillset in RNAi drug development and is truly international with global vision. We have confidence that Sirnaomics will advance its technology platforms and novel therapeutic pipeline with sound clinical and regulatory strategies.”

Sirnaomics reported in April positive phase 2 clinical trial results for its treatment of cutaneous squamous cell carcinoma, a form of nonmelanoma skin cancer. The company plans to advance that product to the next stage, it said, while conducting other studies for its lead product candidates in multiple cancers and fibrosis diseases. Its pipeline includes treatments for liver, bladder, skin, colon and breast cancers; scar reduction and healing, and liver and lung fibrosis, and influenza, among others.

The business in June spun off RNAimmune Inc., a new company focused on messenger RNA, or mRNA, therapeutics and vaccines. That company then closed a $2.35 million seed round in August to advance its cancer vaccine program as well as its Covid-19 vaccine candidate. Its president and CEO, Dr. Dong Shen, is an alum of AstraZeneca (NYSE: AZN) and Johnson & Johnson (NYSE: JNJ), with experience in infectious disease, oncology and rare disease areas.

The latest capital for Sirnaomics comes on top of $58 million the company previously raised, including $47 million in Series C financing in 2019. Sirnaomics also obtained another $10 million in government grants and corporate partnerships. The company was valued at more than $200 million as of April 2019, per an email from Chief Medical Officer Michael Molyneaux at the time.

Its IPO wouldn’t be the first local exit this year. Reston’s SOC Telemed and Silver Spring’s Aziyo Biologics are now debuting on the public markets, along with several others.

Sirnaomics, headquartered in Montgomery County, has subsidiaries in Suzhou and Guangzhou, China. The company, established in 2007, has since become a leader in the field, focused on targeted therapies for critical human diseases using RNAi technology. Lu founded the company after leaving Intradigm Corp., a Rockville RNAi therapeutics company he’d co-founded, where he served as executive vice president for six years. He also worked at Novartis (NYSE: NVS) and Digene, with 15 years of experience in the biopharmaceutical industry and 25 years of biomedical research.