In Woodbridge, Va. sits former Pentagon system engineer Govinda Giri, the man behind the local company that marries social media with e-rebates and cashback systems. In short: Users can earn money just for using the social media site.

Giri came up with the idea for Sagoon, which is headquartered in both Woodbridge and New Delhi, India, after his first startup failed. He was trying to build a search engine that could compete with Google — no easy feat, of course.

When that failed, he turned to social media and rebates.

"We want to connect emotionally, not the physical connection," Giri said in an interview. "We want to share what we have with the people we love — the knowledge they have."

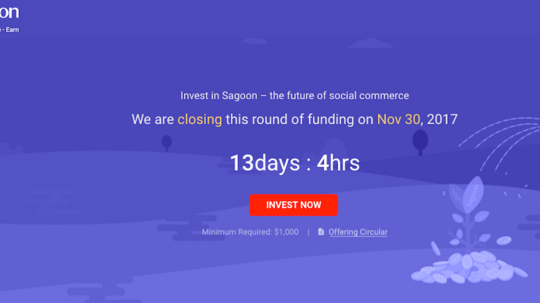

To fund Sagoon, the almost 50-person company is turning to equity crowdfunding for its next round. For those out of the loop, equity crowdfunding is pretty much exactly what it sounds like. Companies turn to their close networks -- friends, family, acquantainces, users -- and ask them to invest in the platform through a crowdfunding platform, similar to Kickstarter or Indiegogo, except people actually receive equity in exchange for buying in. Sagoon is offering $23 per share with a minimum investment of $1,000.

According to a press release on Nov. 9, the company had already surpassed $1.8 million in the equity crowdfunding raise, which closes on Nov. 30. Sagoon's goal is to raise between $5 million and $20 million. The same release states that this milestone puts Sagoon at a total of around $3.2 million raised since they were founded in 2012.

Here's how Sagoon works: The social platform is aimed at creating what they call "real connections." Users have features like "My Day," where they can share their calendars with whoever they want (For example, say your mother wants to know where you'll be that day so she doesn't worry, Giri said), and "Secret," where users can tell their story in pictures, reveal secrets and share personal moments.

At the same time, users can earn money and retail discounts by using Sagoon through its "Social Card" product. Giri said that social media companies make hundreds of dollars off of an individual user's data, yet the user sees none of that income. Instead, Giri said they're loading the social card with 5 percent of the total revenue they make off of each user.

"Because of your activity on Sagoon, when we make $100 you get $5," Giri said.

Sagoon is clearly targeting India's user base, with documents from their equity raise presentation showing that India makes up 29 percent of the world's population, but only 9 percent of social networks. And the company is growing. In February 2015, they had just 116,000 registered users. Now, they have over 1 million.

According to the company's offering circular, they have quite a few risks to their business. For one, the stiff competition in the social media industry.

"Some or all of these companies will have far more financial resources, a more established track record and more experience in the business than the company and there can be no assurance that we will be able to successfully compete," the circular reads about Sagoon's competition in India, Nepal and the U.S.

Another risk is the company's intellectual property protection. They haven't secured it yet.

"The names and/or logos of company brands (whether owned by the company or licensed to us) may be challenged by holders of trademarks who file opposition notices, or otherwise contest, trademark applications by the company for its brands," the circular reads. "Similarly, domains owned and used by the company may be challenged by others who contest the ability of the company to use the domain name or URL."

The rest of the risks are pretty standard: The risk that they won't actually raise enough to meet their capital needs, the risk that they'll be hacked, the risk that the economy could change and alter their business model — to name a few.

Giri said a lot of their users have now become their investors, and once the round closes, they plan to use the funds to expand their office in India, launch the physical product of the smart card and invest in user growth. The team has 50 designers in India, five marketing employees in Nepal and three full-time executives in the D.C. metro area.

"Now is the time to grow, and in the past, we were struggling and trying to find our story," Giri said.