Minnesota's health care startups pulled in a record amount of cash in 2020, but the action was dominated by a few later-stage companies able to shake off the volatility created by the Covid-19 pandemic.

That's according to the Medical Alley Association's annual Startup Investment Report. Minnesota's health care startups raised a total of $1.4 billion, $220 million more than in 2019.

Yet the total number of deals for the year fell. Seventy-three companies raised money from institutional and angel investors in 2020, down from 98 in 2019.

That dip is in part explained by Covid, which made some investors more cautious, said Medical Alley Vice President of Intelligence Frank Jaskulke. Another possible factor: Minnesota's angel tax credit, which was available in 2019 but not in 2020. The credit will return in 2021, which might have led some small investors to take the year off, he said.

Still, the fundraising success of Minnesota's larger health care startups proves those factors are just temporary obstacles.

"We saw the demand for health care in this environment is still there," Jaskulke said.

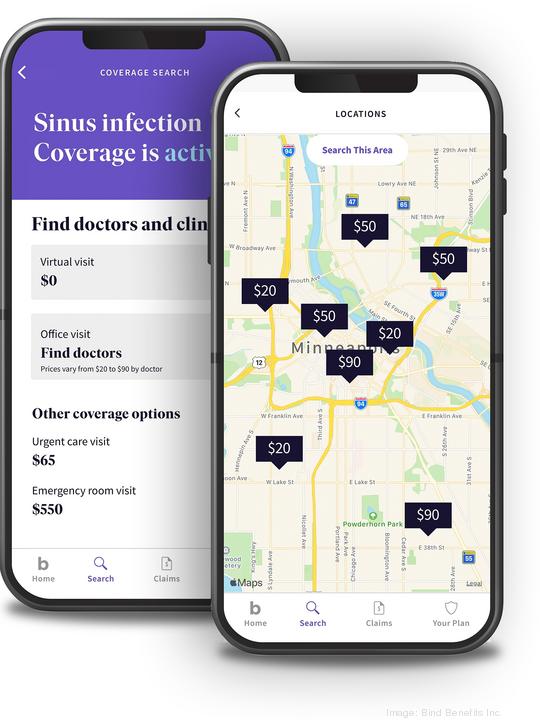

In some categories, Minnesota was nationally dominant. Two startup health insurance companies, Bright Health Group and Bind Benefits Inc., accounted for half of the venture capital raised by such companies nationwide in 2020. Bright led the way with a $500 million Series E in September., while Bind raised a $105 million Series B round in October.

The state's three other largest health care fundraising efforts were Preventice Solutions' $137 million Series B in July; Relievant Medsystems Inc.'s $70 million deal in Nov. and CVRx Inc.'s $50 million round in July.

The success of Minnesota's health plan startups isn't a surprise, Jaskulke said. Both Bind and Bright had founders who were previously executives for Definity Health, another health care startup that was sold to UnitedHealth Group in 2004.

"There's a long history of payment innovation and insurance innovation in Minnesota," he said.

Looking forward, Medical Alley expects Minnesota's market is now ripe for a big exit in 2021. In fact, it's already had one with Preventice's sale last week to Boston Scientific, who bought it for $925 million cash upfront with the possibility of an extra $300 million based on various milestones.

But the possibility of another IPO or a large acquisition in 2021 seems to be growing owing to the relative maturity of many of Minnesota's companies, Jaskulke said. CVRx, for example, has had one of its products approved by the FDA and is just raising money to support commercialization. Bright, meanwhile, has at times talked candidly about its aspirations of a public offering.

"It feels like many of the pieces have been laid. It's an exciting time," he said.

And, Jaskulke said, he's aware of a few of Minnesota's medical startups that are working on rounds of fundraising right now, though he wouldn't say which ones.