Digital Health. Mobility. AgTech. Fintech. Logistics. Industrial IoT. Enterprise SaaS.

In the Midwest, these industries have deep roots and are well-known in the tech world for providing successful outcomes. Most VCs not already investing here have started to take note and jump in. But what about the other half of the tech world - B2C?

Facebook, Google, Apple, Uber - stereotypical examples that are so close to the consumer they’ve created new words, glued us to our smartphones and created customers with a near cult-like devotion to their founders. These coastal icons seem to have almost created a myth that you have to be in SF, NYC or LA to create a successful B2C company. Subsequently, while access to early capital has grown as a whole for early-stage startups in the Midwest, most consumer-facing seed-stage startups still struggle to raise local capital.

While B2B companies remain a majority of our portfolio, we aren’t strangers to Midwest consumer-facing startups. We’ve invested in cold-brew coffee shots in Minneapolis, a women’s travel fashion brand in St. Louis, a hip-hop smartphone app in Columbus, a network of convenient printing stations in Chicago and a robotic toy mouse in Champaign. We’ve clearly identified an opportunity here, even though capital remains limited. So what are we seeing that has us writing checks?

A realistic mass-market representation of the American consumer

It pays to be close to your customers, and sometimes more importantly, to get an accurate gauge of who your customers really are and what they really want. If you want to build the next B2C unicorn, you’ll eventually have to sell to customers in Chicago, Minneapolis and Cleveland as you scale. If the people around you early on don’t represent “middle America”, then both VCs and founders might think it’s a good idea to put $120M into a $700 juicer, for example.

There’s a saying that originated in show business to test if an event would appeal to the mainstream - “Will it play in Peoria?”. Nowadays, Peoria may not be the ideal test market, but the moderate, practical Midwest consumer as a whole might be. These ‘flyover’ consumers hail from a lot of different backgrounds - no single industry dominates, there is a healthy mix of urban, rural and suburban, there are large minority populations and the average citizen tends to be more moderate politically. While many trends do first take root on the coast and spread inward (we’re looking at you, kombucha), when we see a consumer startup gaining users and growing in the heartland, we take that potential seriously. Additionally, this may mean we are more attune to large, vibrant industries a cosmopolitan individual might easily brush over, like hunting & fishing.

Deep expertise in retail and CPG

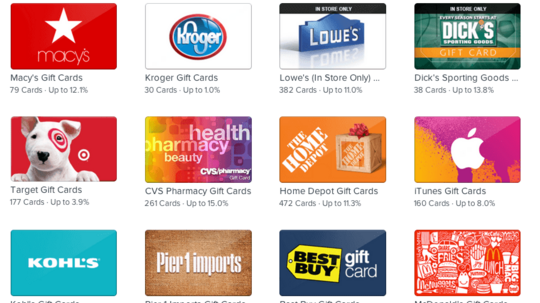

The Midwest may not have the strongest roots in some consumer industries like entertainment (LA), consumer electronics (SF) or advertising (NYC). But we have a deep bench of large companies, and with it expertise, connections and partners/acquirers, specifically in retail and CPG. Across the region you’ll find the headquarters of household brands like P&G, Kraft, General Mills, Hormel and Mondelez, restaurants like McDonald's, Wendy’s and YUM Brands, and retailers like Target, Walgreens, Macy’s, Kroger and Best Buy. These corporations continue to stay relevant and close to the consumer, and many are amongst the most innovative large companies in the world. For example, Target regularly partners with startups coming out of Techstars Retail in Minneapolis, and Cincinnati’s startup ecosystem works closely with P&G and Kroger. These impressive connections and deep understanding of consumers should enable and support B2C tech’s growth throughout the region.

An emerging history of large consumer exits

The region has already begun translating it’s deep understanding of the everyday consumer and strong industry connections to successful venture outcomes. Since 2010, Groupon, Orbitz and GrubHub all exited north of $1B, and RxBar, TrunkClub and SkinnyPop weren’t far behind. And we can see some others on the horizon: Raise.com, hudl, EBTH, Fooda and Varsity Tutors demonstrate the breadth of success thriving around the Midwest. These initial exits will be the backbone of capital, expertise and network for future startups to rise. We are starting to see this positive cycle flourish: The Groupon founders started a VC firm and backed emerging B2C stars SpotHero and Fooda. The Trunk Club founder Brian Spaly is sitting on the boards of Luxury Garage Sale and M1 Finance. Grubhub founder Mike Evans is starting a new startup called Fixer.

All of this being said, there are remarkably few investors specifically chasing these deals. On the accelerator side, The Brandery in Cincinnati and Techstars Retail in Minneapolis stand alone with their sole focus on consumer and retail companies. When it comes to venture firms, the choices are remain limited. Listen Ventures in Chicago has prioritized strong consumer brands since 2010, and was joined by Corazon Capital (with expertise from serial founder Sam Yagan, founder of Sparknotes and OKCupid) in 2016.

Pritzker Group Venture Capital has an impressive track record in consumer as well, with recent investments in Wise Apple, Tovala and Interior Define. Otherwise, most regional VCs either completely avoid consumer or have it relegated to a small, unprioritized part of their portfolio. If this is the missed opportunity that we think it probably is, we wouldn’t be surprised if consumer-friendly coastal firms ultimately swoop in to correct the market. And while they’re here, they should check out this rapidly-growing B2C startup in Peoria (my Midwest wife loved it!)

Victor Gutwein is the founder and managing director of M25, a Midwest-focused VC firm targeting early-stage tech companies. Over the past few years, Victor has invested in over 50 startups in 10 Midwest states. Here, Victor writes every month to share his thoughts from his travels and experiences working with founders, VCs and others in the region.

Featured Image is via Raise.com