The rise of artificial intelligence could mean more economic development wins in the Triangle – even amid concerns that automation will displace workers across most sectors.

Richard Boyd, the serial AI entrepreneur behind Chapel Hill firms Tanjo and Ultisim, calls AI the “new scientific method,” where instead of a human coming up with a hypothesis and designing experiments, “you just hand over the whole problem.” While a human might be able to test a concept 10 times, AI can implement thousands of tests at once.

And he sees applications in economic development.

Imagine if AI could customize the Triangle’s story depending on who is inquiring? A giant company like Apple (Nasdaq: AAPL), for example, could come to a website and see a story “crafted just for them about why they should move their business to Chatham County.”

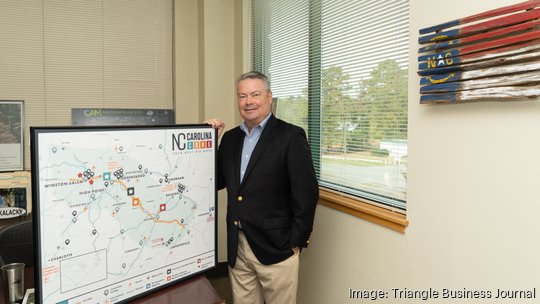

Michael Smith, president of Chatham County Economic Development Corporation, has had conversations with Boyd and calls the possibility “exciting.” Christopher Chung, CEO of the Economic Development Partnership of North Carolina, said his group is also considering ways that AI might enhance performance and effectiveness.

But recruitment is just one application of a technology they also think could bring jobs to the region.

While, globally, much of the worry surrounding AI is around its ability to automate – IBM CEO Arvind Krishna, for example, said recently that 7,800 jobs could be replaced by AI and automation – there could be opportunity in regions willing to invest in the workforce to power it. Regions like the Triangle.

Close to the action

Smith said he’s seen inquiries from tech firms wanting to be close to Triangle tech innovation. He’s also seen interest from data center projects to power them. As those kinds of operations don’t need the massive acreage that recent manufacturing wins such as Wolfspeed (NYSE: WOLF) and VinFast require, there are more real estate options.

Boyd said the Triangle has many of the pieces in place to attract AI innovators.

“We have the workforce,” he said. The goal now is to increase awareness of that workforce.

The rise of AI is having a positive impact on other big tech sectors – such as quantum computing, the sweet spot of Atom Computing, whose CEO Rob Hays is based in Cary. Hays was recently at a founders retreat and said AI was what “everybody’s talking about.”

Hays also sees opportunities in North Carolina. On top of its university-fueled high-tech workforce, the state is a major player in sectors where AI is supposed to be transformative such as life sciences and banking.

The biggest barrier to growing AI and quantum innovation? Capital, Hays said. Much of the venture capital dollars fueling local efforts in data technologies are coming from outside of the area.

The need for capital

“We need capital, and that’s always been a problem in North Carolina,” Boyd said. “We’ve got a bunch of AI companies in this area, we’ve got some great universities … we’ve got the workforce, the really, really smart people. We need capital."

The good news, Hays said, is that in the era of remote working, West Coast investors are even more willing to invest outside of Silicon Valley.

“They’re funding innovation everywhere … wherever innovation is,” he said.

And numbers from 2022 back that up. Of the 325 groups investing in North Carolina, 93 were from the West Coast, according to numbers compiled by the CED in Durham.

Data center projects are eyeing the state. While they don’t typically bring high levels of jobs, they do mean major capital investment – and typically support companies that do hire heavily.

“The data-heavy projects are going to go where the power is,” said Andrew Tate, head of economic development for Duke Energy (NYSE: DUK). “They’re not driven by workforce the way your traditional industrial project is.”

With North Carolina’s history of having lower power costs than some other states, Tate said North Carolina will likely see continued success in that space.

Chung said in an email that it’s unclear the impact of AI, but that it all underscores one thing, “that the need for an even better-educated and skilled workforce will only continue to increase.”

AI and Big Data are just two sectors economic developers say they’re targeting, as they continue to prioritize the so-called mega-project, major manufacturing operations that can mean thousands of jobs.

While 2023 hasn’t seen the mega-deal headlines projects such as VinFast and Wolfspeed brought to the state in 2022, Tate thinks it’s only a matter of time before the next blockbuster project.

“There’s still probably the same amount of economic development activity happening in the background this year as there was last year,” he said. “We’ve just seen delays in decisionmaking.”

His comments echo what local economic developers have said.

Norris Tolson, who heads up the Carolinas Gateway Partnership in Rocky Mount, recently told Triangle Business Journal a number of mega-projects – including EV battery makers – were eyeing a megasite in Eastern North Carolina.