Following years of development, a Durham firm is transitioning to a commercial-stage company.

In late December, the U.S. Food and Drug Administration granted approval for Polarean Imaging's drug device combination product, called Xenoview. After a decade in development, the company is rolling out the commercial launch of its technology with the hopes of improving care for patients with lung diseases.

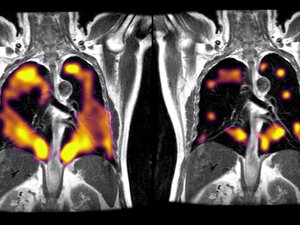

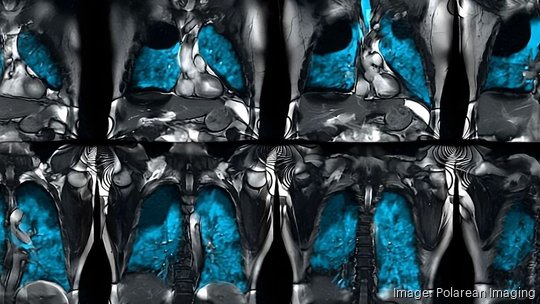

The FDA approved Xenoview "for use with magnetic resonance imaging (MRI) for evaluation of lung ventilation in adults and pediatric patients aged 12 years and older." The product includes both a system, a piece of capital equipment, and a xenon gas blend that patients inhale prior to an MRI.

The company says its technology opens up new possibilities for MRI use in a major area of health care. More than 30 million people in the U.S. live with a chronic lung disease, like asthma or chronic obstructive pulmonary disease (COPD). Xenoview gives physicians a clearer view of diseases in earlier stages or milder forms that might not have been identified through other methods without exposing patients to radiation.

"We're hoping we can pick up diseases earlier to help better manage patient outcomes," said Polarean Chief Commercial Officer Alex Dusek.

Polarean's technology spun out of GE HealthCare in 2012, said Bastiaan Driehuys, Polarean founder and chief technology officer. Driehuys is also a professor of Radiology at Duke University. This connection to Duke led the company to set up a Durham office, which has about 20 employees. The company also has about five or six employees who are not on site and make up a field team of sales and medical roles.

Over the past 10 years, the company has established a base of medical centers that use its technology for research purposes in areas like asthma or COPD. With FDA approval secured, the company is focused on converting these research sites to customers that can use the technology while treating patients in clinical settings. The company reached a milestone in May when its technology was first used for a clinical scan of a patient with cystic fibrosis at Cincinnati Children's Hospital Medical Center.

In addition to converting these research sites — which include 10 in the U.S., five in Canada and three in Europe — Polarean plans to reach out and sell its technology to new centers. Dusek said the company aims to have five systems placed this year as part of its sales process.

The company also sees opportunities for industry collaborations, like working with pharmaceutical companies that are looking for additional insight as to whether their drugs are working. Dusek said the academic centers Polarean works with have run drug trials that use this technology as an endpoint for studies.

"That’s a part of our business that we will be focusing on this year," Dusek said. "How do we partner with pharmaceutical companies and build a model there together?"

Other industry collaborations include partnerships with MRI manufacturers, like Philips (NYSE: PHG). The two companies recently announced a collaboration that will combine a Philips MRI system with Polarean's Xenoview technology. Dusek said Polarean is in discussion with other MRI companies about enabling their systems to work with Polarean's technology.

The company is focused on gaining traction in these various commercial areas over the next four to five months to position itself to raise additional capital. Polarean, which is publicly traded on a submarket of the London Stock Exchange, ended 2022 with $16.4 million in cash — an amount expected to fund the company into 2024. The company reported a loss of about $13.9 million in 2022.