Attention, startups: IBM’s next buy could be just around the corner.

“We are always shopping,” Tom Rosamilia, senior vice president of IBM Software, told analysts at the Evercore ISI Technology, Media & Telecom Conference this week.

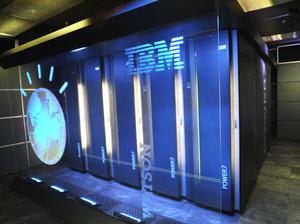

IBM (NYSE: IBM), which has one of its largest campuses in Research Triangle Park, made what’s been touted as its most transformational buy in Raleigh when it acquired open source software firm Red Hat in 2019.

Rosamilia said the firm is “always looking” for more companies to add to its portfolio, but that its net is extremely narrow.

“I always want it to be something that’s a close relative,” he said of M&A targets. “I want it to be a close cousin or a brother or sister or something we’re already doing. If it’s too far afield, I’m not going to get the benefit of the synergy from our sales force.”

Specifically, he’s eyeing prospects in areas such as data, automation and cybersecurity. He pointed to buys such as Instana and Turbo that play in the automation space.

“Those fit nicely into our automation portfolio,” he said. “They’re not brand new areas that I have to figure out.”

IBM has made 13 acquisitions in the software space since 2020, though none nearly as big as the $34 billion deal for Red Hat.

“What you’re really doing there is … acquiring skills and skills that clients need today,” Rosamilia said of the strategy. “Skills that are in our strategic areas of investment.”

Rosmilia was asked if IBM might be more active on the M&A front given what’s happening with valuations on the public markets. “I mean at the right price, absolutely,” he said, adding that private companies are “a little bit behind” the public markets when it comes to understanding valuations. “But we’re shopping.”

It’s unlikely that IBM would find a deal quite like Red Hat. The acquisition has been a “great asset,” Rosamilia said. IBM gave Red Hat sales scale and Red Hat allowed IBM to pivot to hybrid cloud.

Five years ago, IBM was all in on public cloud and Watson, its AI platform. “And now the pivot’s really been to hybrid multicloud and AI everywhere,” Rosamilia said.

He said the pivot to hybrid cloud is enabled by Red Hat, and that IBM’s own systems are a big beneficiary.

“We’ve modernized all of our software portfolios based on containers, made them cloud native,” he said. “And I couldn’t have done that if Red Hat had remained independent on the chance they could have been bought by somebody less favorable to me. So in order to rebase all of my software … I needed to have Red Hat in some level of control.”