Speaking on the heels of Reveal Mobile’s buyout of New York location intelligence company Mira, Reveal's CEO offered advice to other entrepreneurs looking to grow their companies through buyouts.

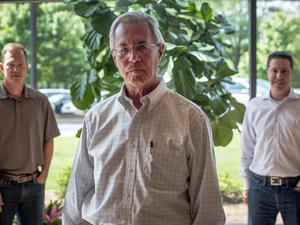

Brian Handly, CEO of the Raleigh-based geofencing marketing company looking to help firms leverage location data to reach their target audiences, has a pedigree worthy of advice-giving. Before cofounding Reveal Mobile and acting as an advisor to a slew of area startups (including both Automated Insights and DigitalSmiths, both of which had exits), he led Accipiter through its buyout by Atlas (and eventually Microsoft).

The firm’s just-announced buy of Mira doesn’t just add value to its software suite. It also adds to the team in a time when it’s hard to hire. And it could help improve the margins – as separate entities, the companies were often buying the same data sets.

But deals, regardless of size, typically take time, particularly when it comes to due diligence. Handly said entrepreneurs shouldn’t enter them lightly.

He said deals start with knowing exactly what you want.

“You really need to understand why you want to go through the process of acquiring or merging with somebody,” he said.

As Reveal Mobile was planning its growth, Handly and his management team sat down and tried to categorize a list of potential targets. “We looked at targets in terms of will this help us accelerate the roadmap?” he said.

The company compiled another category in terms of the diversity of the data.

“We’re almost solely focused on mobile location data,” Handly explained. “Does it bring in additional data types?”

The last list involved risk mitigation. Reveal Mobile deals in data, and there are challenges – particularly with iOS’ decisions about privacy features and the “war on third-party data cookies.”

Mira fit two of those buckets, Handly said. But there were actually about six companies in each category Reveal considered as it was doing its research.

When you’ve identified a target, have the valuation conversation very early in the process, Handly said.

“They can be a great fit structurally, but if there are two very different views of how each company should be valued, that’s going to make it very hard for those companies to come together,” he said.

Handly also said you have to talk about revenue streams for each company. In the case of Mira, the firms signed a term sheet in March. After overcoming credit facility issues, the deal was finally announced Tuesday.

Including Mira, Reveal Mobile has 34 employees.