A venture capital firm in Durham that invests in African American entrepreneurs is about to start writing larger checks.

Resilient Ventures, whose Fund 1 closed at just under $3.5 million, is targeting $15 million for its next iteration. Resilient Ventures Fund II recently disclosed its first close via a filing with the U.S. Securities and Exchange Commission.

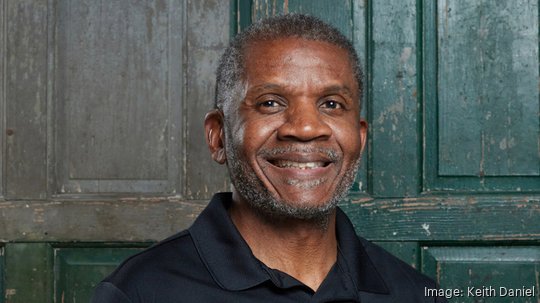

So far, 13 investors have funneled in nearly $2 million. But the fund has much bigger aspirations – $15 million, according to Keith Daniel, Resilient Ventures co-founder and manager director.

Daniel said fundraising is ongoing and that Resilient hopes to write the first checks from the fund in the first quarter of next year. The goal is to write checks of about $250,000 for pre-seed firms and $750,000 for Series A investments, he said.

“We’re already evaluating prospective companies now … we’ve already started the work of preparing ourselves for finding deals and beginning the process,” he said, noting interested entrepreneurs of color can reach out online.

The fund is relatively sector agnostic – though its Resilient's sweet spot has been tech firms in the B2B space. It targets companies with six to 12 months of revenue. Like other local firms, it targets the Southeast (though it has previously funded companies as far away as Chicago).

But it does have a big differentiator – the fact that it specifically focuses its dollars on people of color.

Daniel, who met co-founder Tom Droege in the mid 2000s through friends in the mission field, said it’s a way to affect change through investment.

The last fund made 11 investments, including locally in The Diversity Movement. This time around, Daniel hopes to invest in 15 ventures.