A Raleigh-based craft distillery is offering the opportunity for its supporters to invest in the business through its recently launched crowd equity campaign.

Lonerider Spirits is using online platform WeFunder to raise capital by allowing individuals to invest in the private company. The option is possible through regulation crowdfunding, according to the U.S. Securities and Exchange Commission. Private companies are eligible if they comply with Reg-CF (regulation crowdfunding) rules, including working with a broker-dealer or funding portal that is registered with the SEC, and raise no more than $5 million in a 12-month period.

“Raising funds anywhere is always a tedious process,” said Sumit Vohra, CEO of Loneriding Brewing Company. “You have the standard path of talking to venture capital [firms] and private equity groups, and you have great angel investors in the area, but regular crowdfunding became viable in North Carolina only about a year and a half ago.”

The distillery operation was born in 2018 from Vohra's Lonerider Brewing Company and its spirits are available throughout North Carolina. On its WeFunder page, Lonerider Spirits provides its financial information and plans for growing the business. According to the page, the funder has raised nearly $125,000 from 60 investors. The goal is $1 million.

Lonerider Spirits had revenue of nearly $350,000 in 2020 – up 52 percent year-over-year – and has $230,000 in cash on hand, according to its WeFunder page.

The minimum investment is $100 for the Lonerider Spirits funder.

Previously, the ability to purchase shares in a private company or participate in returns based on their revenue had not been available through other crowdfunding sites such as Kickstarter, Vohra said.

He said If Lonerider Spirits is successful as a company, then investors will see a reciprocal return based on what they invested.

The company teamed up with Raleigh-based Incolo, formerly CrowdfundNC, after seeing how much regulation crowdfunding has grown in popularity in recent years, Vohra said. He serves an an adviser for Incolo, which launched in 2019.

"We are a traction studio, helping founders build investable businesses with the 'crowds' who help fuel their growth," said Incolo CEO and founder Will McGuire.

In 2020, the total amount of regulation crowdfunding in the U.S. increased over 77 percent to $239.4 million. That number is expected to double in 2021, according to a report from Crowdfund Capital Advisors.

“This is just the start of regulation crowdfunding in general,” said Vohra, who emphasized how thankful he is for the support he's received from the company so far. “For a long time, everybody didn’t have access to the same deals that a limited group did. We are hopeful we’ll be able to reach our larger goal.”

The current format for private market offerings became available in 2016 – decades after the SEC implemented safeguards for investing in securities following the Great Depression, McGuire said.

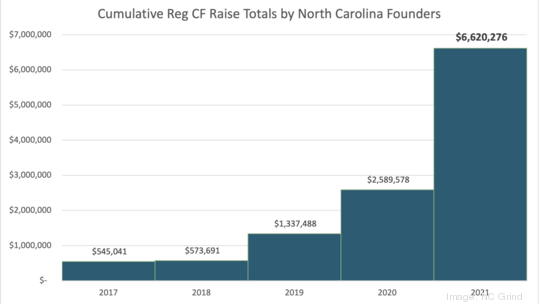

Since then, nearly $1 billion in capital has been raised by founders in the U.S., McGuire added. As of May 2021, about $6.6 million has been raised in North Carolina.

"People put their money on the line because they love a company and the founders, but they're also looking into the potential financial rewards from access they have never had for over 80 years because laws prevented this," McGuire said.

Although one of the biggest challenges companies face is keeping up interest for the duration of the campaign, all industries have been successful using regulation crowdfunding with the proper planning, marketing and research, McGuire said.