Bennett College – which has been climbing back from nearly two decades of financial struggles and enrollment declines – is now a limited partner in a venture capital fund.

The historically Black women’s college has announced its involvement with The Historic Fund, a new venture capital fund of over $10 million designed to help historically Black colleges and universities grow their enrollments.

The Historic Fund operates as a fund-of-funds, so that the money is donated by individual general partners from 10 venture firms. In turn, that capital is invested into the new funds raised by those firms in proportional amounts, with the potential returns going to the HBCUs as limited partners.

“The Historic Fund gives Bennett College and other participating HBCUs the ability to grow our endowment in ways we never imagined,” said Suzanne Walsh, president of Bennett College. “It opens us up to new opportunities. This model of investing in HBCUs, where we receive the interest benefit, is a very interesting model for endowment growth and fundraising, and The Historic Fund provides a very exciting opportunity for potential investors.”

Triad Business Journal recently down with Walsh, who joined Bennett as the 19th president in 2019, to discuss her plan to get Bennett on a path to success – which includes the belief that the college’s “smallness is its strength.” Read more about Bennett’s path to positive financials here and a Q&A with Walsh here.

“Unique philanthropic initiative” to help close endowment gap

The Historic Fund, which calls itself a “unique philanthropic initiative,” is the brainchild of a group of investors who have stated their recognition of HBCUs’ importance and role in promoting equity and inclusion in higher education.

With an inaugural fund of over $10 million that launched in June, The Historic Fund raised capital from VC firms including Acrew Capital, B Capital, Cowboy Ventures, First Round Capital, FirstMark Capital, Foundry, General Catalyst, Spark Capital and Union Square Ventures.

Josh Kopelman, co-founder of First Round Capital and an organizer of The Historic Fund, told Axios that First Round partners tried to recruit HBCUs as limited partners about seven years ago but the idea proved unsuccessful as HBCUs lacked capital that was investable in illiquid assets.

“The real story for me is not the VCs; it’s the HBCUs and it’s the endowment gap – and the gap’s been growing in part because of the success of venture firms,” Kopelman said.

HBCUs have much smaller endowments than predominantly white institutions. An analysis of 2022 data from the National Association of College and University Business Officers by HBCU Money showed that no HBCU endowment hits the $1 billion mark, while 136 predominantly white institutions do. There are 69 predominantly white institutions that surpass $2 billion.

Across town in Greensboro, N.C. A&T State University – the largest HBCU in the country – reported an endowment of over $164 million, landing it at No. 6 in the largest HBCU endowments.

Bennett’s endowment, growing slowly over the past few years, now reaches over $14.2 million. Walsh told TBJ that Bennett has been involved in ongoing fundraising efforts and plans to use the college’s 150th anniversary this fall to increase its major gifts.

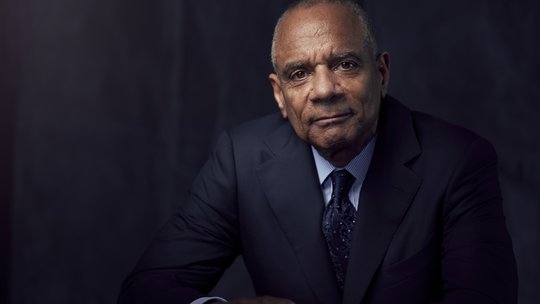

“As we continue to combat the racial inequities that Black students face, The Historic Fund aims to relieve the disproportionate financial pressure on Black families while also providing essential funding for research and innovation at each of these institutions,” said Ken Chenault, former CEO of American Express and current chairman and managing director of VC firm General Catalyst.

As limited partners that are not investing their own assets, HBCUs will be able to use the returns as they see fit, the Historic Fund said.

Helping HBCUs enter the VC community

The goal of The Historic Fund is twofold, with the first goal being to bolster the endowments of HBCUs and the second goal being to foster relationships between the HBCUs and the venture capital ecosystem.

The Historic Fund said it hopes to leverage its position as the connector between HBCUs and the VC ecosystem to develop programming and opportunities for students in entrepreneurship and innovation. The fund will also support underrepresented fund managers through its stake in First Close Partners, a venture fund whose mission is to make venture capital more inclusive.

It said it will also support higher education administrations that are exploring alternative asset class strategies with their endowments.

Along with Bennett College, the inaugural cohort of HBCUs includes Benedict College, Fisk University, Florida A&M University, Hampton University, Morehouse College, Virginia State University, Virginia Union University and Xavier University of Louisiana.

In addition to Chenault, The Historic Fund has attracted several executives at VC funds around the country, including Dr. Regina Benjamin, former U.S. Surgeon General and founding partner of First Close Partners. The fund is led by Executive Director Adanma Raymond.