A startup hoping to disrupt the mortgage market launches in Raleigh this week.

Ownify on Monday announced a $7 million seed round led by Lobby Capital. The company is using the funds to sell customers on the idea of deploying fractional ownership – not mortgage debt – when they buy their first home.

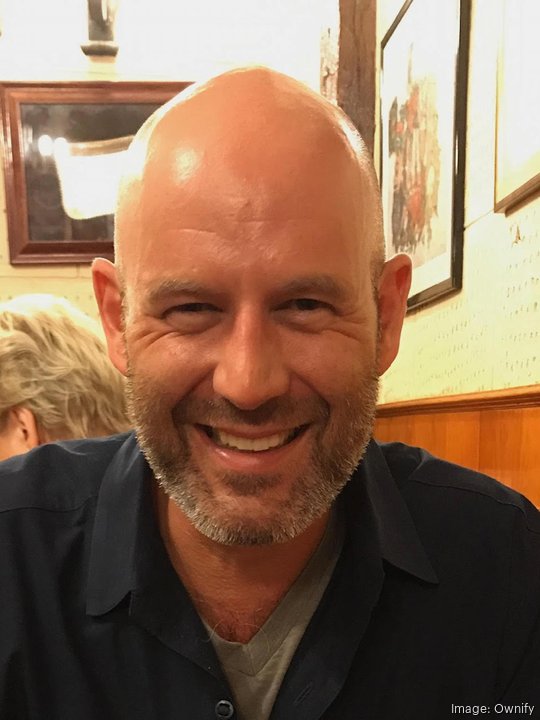

And, even though CEO Frank Rohde is based in San Francisco, it’s starting in the Triangle.

Rohde came up with the idea after realizing mortgages “do not really work for the first-time homebuyer.”

“It’s just way too concentrated of a risk,” he said, adding that rising interest rates exasperate the math.

In an interview, Rohde talked through the concept and why the firm – whose employees work virtually across the country – picked Raleigh for the debut.

How Ownify works

Homebuyers make a 2% down payment to qualify to buy their home with Ownify and get a 2% equity stake upon closing. Ownify allows them to be cash buyers – which gives them an edge in competing in tight housing markets – and it also covers additional upfront costs such as due diligence fees and earnest money.

They then pay a fixed monthly payment to Ownify, which includes a monthly equity buy that increases their ownership percentage. It also includes a monthly occupancy payment on the fraction of the home not yet owned, which covers costs such as maintenance and repairs, homeowner’s insurance and taxes.

Ownify describes it as buying the home “brick by brick.” After five years, buyers own about 10 percent of the equity. They can buy the remaining equity at any time at fair market value, or cash out and walk away.

Company origins

Nearly two decades ago, Rohde, who came to the U.S. from Germany for school and then migrated to California for its tech scene, was trying to buy his first home. But in applying for mortgages, he realized he was short $30,000 on the down payment. His parents were able to front him a loan, which he paid back two years later.

He didn’t think about the situation again until about two years ago, while having a conversation with customers of his last startup, Nomis Solutions, about first time homebuying struggles. Several in the group had similar stories – including Ben Herald, who would become his co-founder.

The idea started to take hold.

“Once you did the research, about 50 percent of first-time homebuyers need help from family,” he said. “Often it’s a gift, sometimes it’s a loan … so that struck a chord. Why isn’t there an institutional solution?”

Nomis, which built the pricing engine used by the likes of Wells Fargo and SoFi, sold to Symphony Technology Group and, while Rohde stayed on through the transition, the idea kept circulating.

“There really isn’t a good solution for the first-time buyer, and the problem is getting worse and worse,” he said.

The competition in markets like the Triangle compound financing issues. If buyers have any financial contingency – they’re easily beaten out by all-cash offers, he said.

So Rohde decided to come up with a solution. And after evaluating more than 300 housing markets in the U.S., the team decided to launch in the Triangle first. The goal is to roll it out locally and then expand to Charlotte before going national.

The question is, will the Triangle buy in?

Yes, Rohde said, because Ownify allows first-time homebuyers to compete with a cash offer – but that new homeowner owns just a fraction of the new house. And like a mortgage, it requires regular payments to get the title.