Minerva Lithium has been on a roll, racking up win after win at pitch competitions around the country. And now, the UNCG spinoff is looking to raise $10 million by early next year.

In less than two months, Minerva Lithium – which is developing a filtration technology to better extract lithium from water – has been awarded $112,000 from three different pitch competitions.

It received $2,000 from Triad’s own ConvergeSouth Conference in September and then $10,000 from the Innovation Challenge at the Defense TechConnect Innovation Summit and Expo.

But the biggest prize of all came last month, when Minerva Lithium topped the Startup Battlefield at TechCrunch’s Disrupt conference in San Francisco and returned to Greensboro with $100,000.

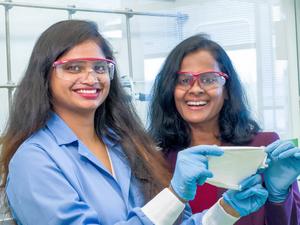

On the heels of this success, Minerva Lithium co-founders Sheeba Dawood, a UNCG alumna, and Hemali Rathnayake, an associate professor at UNCG’s Joint School of Nanoscience and Nanoengineering, spoke with TBJ about what the company is up to now and what comes next.

Pitch competitions bring confidence, validation

To date, Minerva Lithium has raised approximately $600,000, including a $256,000 National Science Foundation Small Business Innovation Research grant from August 2021 and a $75,000 One North Carolina Small Business Program grant from this September.

Dawood said that this was the right time for Minerva Lithium to be seeking investors and venture capital as the company prepares for pilot testing.

“We were actually waiting for it,” she said. “When we gained the confidence and did the lab-scale testing, that’s when we were like it’s time for us to get investors – and pitch competitions are the best way to get them.”

Dawood noted that here in North Carolina, there are not many technical venture firms that are able to fund breakthrough technologies such as Minerva Lithium’s, so attending other national STEM-focused conferences helped the company reach the right people.

“What matters the most is getting this technology out. These competitions and these kinds of platforms helped us to reach out to people, especially TechCrunch,” Dawood said. “It made a significant difference.”

And it was a moment of pride for her and Rathnayake to represent North Carolina across the country.

Rathnayake told TBJ that the funding received from pitch competitions will be used to hire three more employees, bringing Minerva Lithium’s team up to nine.

Minerva Lithium is also wrapping up its NSF SBIR Phase I grant as it progresses toward pilot testing. The company will submit for a Phase II grant early in 2023, Rathnayake said.

In addition to winning pitch competitions, Minerva Lithium has recently received other validation of its technologies. In October, DigitalMara named Minerva Lithium one of eight prominent startups that are bringing disruptive and sustainable innovations and the company announced on LinkedIn that it has been accepted to the Newchip Accelerator program.

Raising $10M and looking to generate revenue sooner

Dawood and Rathnayake want to use the $112,000 in their pocket to propel them forward towards other funding – to the tune of $10 million.

“The small amount that we have received is helping us to reach out – to do the pilot-scale testing and have customer validation – and get more funding,” Dawood said.

Minerva Lithium is fundraising in two separate rounds, Dawood said, with an initial raise of $2.5 million closing in December and a second raise of $7.5 million expected to close in March.

The company already has plans for what it will do with the money from each fundraise, with the $2.5 million helping Minerva Lithium expand its portfolio and tap into a new revenue stream – one that is expected to produce positive returns more immediately than the lithium-trapping technology.

“[There are battery manufacturers who] are interested in not only the lithium extraction but also they are very interested in processing low-grade lithium into battery-grade,” Rathnayake explained. “We are trying to see whether we can position ourselves there and developing novel technology for that and then in the meantime take this [filtration] technology to translational stage with the second round of funding closing in March.”

The lithium extraction and filtration will be a long-term development, with revenue generation not expected until 2024 or 2025, Rathnayake said. Dawood said that by expanding the company’s portfolio and developing technology to process low-grade lithium, with the help of $2.5 million, Minerva Lithium can achieve revenue generation in 2023.

And, Minerva Lithium will do it more efficiently in terms of energy, money and time, offering the same value proposition as with its lithium extraction technology.

“In the lithium ecosystem, we realized domestically there are very few companies that convert low-grade lithium to battery-grade lithium… we are trying to fill that gap and we are there [scientifically],” Dawood said.

Sign up here for the Business Journal’s free morning and afternoon daily newsletters to receive the latest business news impacting the Triad.