Like most founders, Brian Alvarez-Bailey is hopeful for an eventual exit of his latest startup, a fintech company called Allison.

But instead of taking the funds and putting them toward a new venture, cashing out or retiring, Alvarez-Bailey has bigger plans.

“My life mission — not to get all corny — but it’s to make it easier for people like me to work for themselves and be job creators,” he said in an interview with Tampa Bay Inno. “Allison is the conduit to grow equity, and with an exit, that can be the cornerstone to build a utopian version of an incubator where there are no barriers. To me, that’s success if I make it easier for a founder to launch a company.”

Alvarez-Bailey isn’t new to the startup scene. Born in Chicago, he made his way to San Francisco and Austin before moving to Tampa in 2019.

“Tampa to me is where Austin was in 2010; it’s a blossoming tech hub,” he said. “And I figured if I got in the space here now, in 10 years, I could be that much more mature to help other founders — specifically Black founders — succeed.”

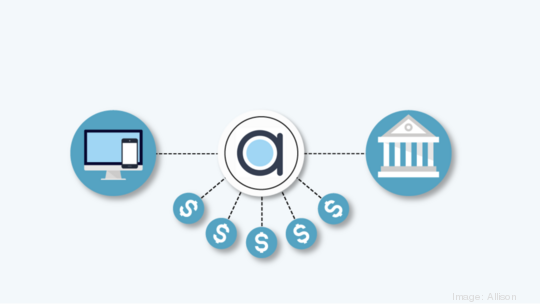

He launched Allison in mid-October at the Jack Henry annual conference, which brings together banking and technology executives. At its core, Allison connects community banks with fintech companies instead of leaving the banks to spend time and resources launching their own products.

“A community bank has less than half a billion in capital assets, and they don’t have the tech infrastructure,” he said. “And a lot of early fintech companies don’t have the licensing to compete with the bank, so they partner with a bank. We broker that partnership.”

The company was named after Alice Allison Dunagan, the first Black female journalist to cover the White House. Alvarez-Bailey is the sole employee and hopes to onboard roughly three to five banking partners in the next year, along with 10 to 20 fintech companies that preferably are minority-led and local.

“My idea is to be the connector, not the silo’er,” he said. “I always try to look at my own backyard. If I want to make an impact in Tampa Bay, I need to work with folks in town before I ever touch anyone outside of it.”

The company is entirely bootstrapped and eyeing a seed round between $350,000 to $1 million while also looking at grants and other avenues of funding. Alvarez-Bailey has already formed strong partnerships within the community: He is a new member at startup hub Embarc Collective and in the University of Tampa Spartan incubator.

He is part of a rising fintech wave that has crashed into the region in the last 18 months, fueled in large part by the Covid-19 pandemic. But while for some the changes are happening at a rapid pace, for Alvarez-Bailey, it’s precisely what needs to happen.

“I’ve felt we’re moving slower than we should be,” he said. “I see so many opportunities, especially in minority communities, to make payments faster and cheaper, which, paradoxically, will make folks spend more. There are a lot of traditional audiences that I want to open those avenues to. So for me, I think it’s a long time coming.”