More than a dozen tech startups from across the nation showcased their growing companies on Wednesday night as the inaugural Fintech|X Accelerator class.

The program was created through a partnership with the University of South Florida and Tampa Bay Wave in 2021 and announced participants in the first cohort in April. Those companies flew in from across the world to present their pitches to a packed room on the USF St. Petersburg campus.

"I described the partnership in a very specific way: It's synergistic, collaborative, highly engaged and it's a direct product of the Tampa Bay area," Michael Wiemer, USF St. Pete's new director of its fintech center, said. "For these groups to come together and create something as innovative as the accelerator, it's amazing and a direct compliment to the talent that exists here."

Get a look at the startups below.

College Cash

What they do: College Cash uses everyday behavior to reduce student loan debt in a unique manner — including user-generated content campaigns — to engage with brands in a way that allows funds to be earned as early as the first year of high school.

Headquartered: Fort Worth, Texas

Standout stats: Won the SXSW "Fast Pitch" competition in the social entrepreneurship category

By the numbers: The company is on track to have roughly $950,000 in revenue by the end of the year, with $16.3 million in revenue by 2024.

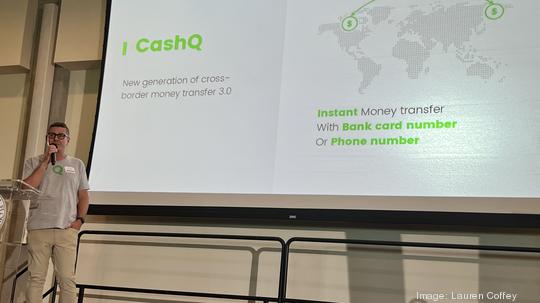

CashQ

What they do: Allows instant bank transfers across 80 countries and counting for fintech and non-fintech companies.

Headquartered: Miami

Standout stats: The company wants to be a "bank as a service" platform and connects with partners like Visa and Mastercard

By the numbers: It is trying to get a slice of the $156 trillion total addressable market in its industry.

FINBOA

What they do: Connects the dots between intake, products, back office and systems for financial institutions to help productivity and reduce inefficiencies.

Headquartered: Houston, Texas

Standout stats: Works with over 95 banks and has grown 50% year to date

By the numbers: Ended with $1.1 million in annual recurring revenue in 2021

Homey

What they do: A proptech platform that makes property closings cheaper and easier for all involved

Headquartered: London

Standout stats: The founder is a physician turned entrepreneur

By the numbers: On track to have $2 million in revenue by the end of 2023 and is raising a seed round of $3 million

Paperstack

What they do: Focusing on boosting women in the e-commerce space by partnering with fintech lenders and allow them to finance customers' entire portfolio of loans on Paperstack's behalf. They charge a 1% origination fee for every loan they refer financial institutions to.

Headquartered: Toronto

Standout stats: Graduated both the Techstars and Google Accelerator programs

By the numbers: Added more than 150 e-commerce members since January 2022 and has a projected gross merchandise value of $5 million by the end of the year. They have $650,000 committed in its current round.

Online application

What they do: A two-sided B2B SaaS web app that makes getting a mortgage easier from start to finish.

Headquartered: Dublin, Ireland

Standout stats: Offers “Fortune 500 tech at a local bank price”

By the numbers: The company has 30 regulated clients and has an expected annual recurring revenue of 1 million Euros by the end of 2022.

SueApp

What they do: Automates the small claims filing process to help achieve personal and social justice for all involved.

Headquartered: Tel Aviv-Yafo, Israel

Standout stats: It launched a pilot with the No. 1 insurance company in Israel and is expected to launch in Florida later this year.

inbanx

What they do: Offers a spend management solution for middle market companies that otherwise cannot control and view the transactions they make across the globe.

Headquartered: Austin, Texas

Standout stats: The founder had multiple previous exits

By the numbers: Expected to have a total revenue of $2.1 million by the end of 2023. It raised a $600,000 pre-seed safe note with participation from JP Morgan, Encore Bank and Blackstone.

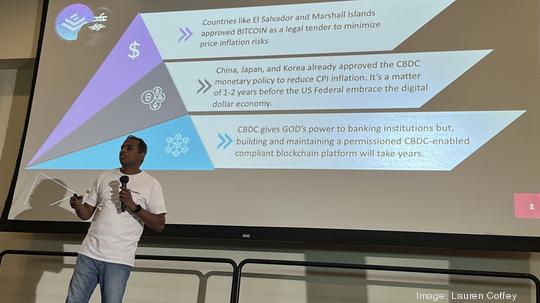

Element

What they do: Claims it offers the first multidimensional, all-in-one stable coin hub for decentralized finance.

Headquartered: Cary, North Carolina

By the numbers: The company has raised over $1 million.

DUKAPAQ

What they do: Offers a communitywide rewards program and digital marketplace for Africa's merchants, called "dukas" — similar to bodegas in New York City.

Headquartered: Tulsa, Oklahoma

Standout stats: Small shops account for more than 80% of Africa's consumer trade sector.

By the numbers: They are running a beta test in 12 stores with a waiting list of 332 in Nairobi, Kenya alone.

myEGO

What they do: Serves as the "gateway of web 2.0 to web 3.0" when it comes to verifying personal identity.

Headquartered: Berlin, Germany

Standout stats: Currently has its technology product ready.

RiskSmith

What they do: Helps the average person invest in stocks the way an investor would — by looking at it through a portfolio-centric view

Headquartered: Tampa

Standout stats: Soft launch is in Q4 2022. The company's CEO previously worked in the product departments at Google and YouTube.

By the numbers: It has more than 350 active users.

SoleCapital

What they do: While things like art and homes have turned into financial assets, the company is looking to do the same for shoes.

Headquartered: Raleigh, North Carolina

Standout stats: It plans to launch soon and could innovative with blockchain and NFTs.

By the numbers: It has a wait list of 40 stores and is looking to work with sneaker conferences, sneaker shops and financial institutions.

Aquablocks

What they do: Offers a platform for commercial and investment banks to secure and manage digital assets with state-of-the-art security.

Headquartered: Tel Aviv-Yafo, Israel

Standout stats: It is working alongside the Israeli FBI.

By the numbers: The founder states the total addressable market is $180 trillion.

VIVA Finance

What they do: Provides a lending platform that offers loans based on employment information rather than credit history, which expands access to affordable credit for individuals with damaged credit histories.

Headquartered: Atlanta

Standout stats: Operating in 17 states, which will soon roll out to all 50.

By the numbers: Has roughly 10,000 customers and expects to hit monthly profitability by the end of 2023.