As tech executives and financial firms alike flock to the Sunshine State, one firm has launched a $20 million fund to further back up the vigorous activity in Florida.

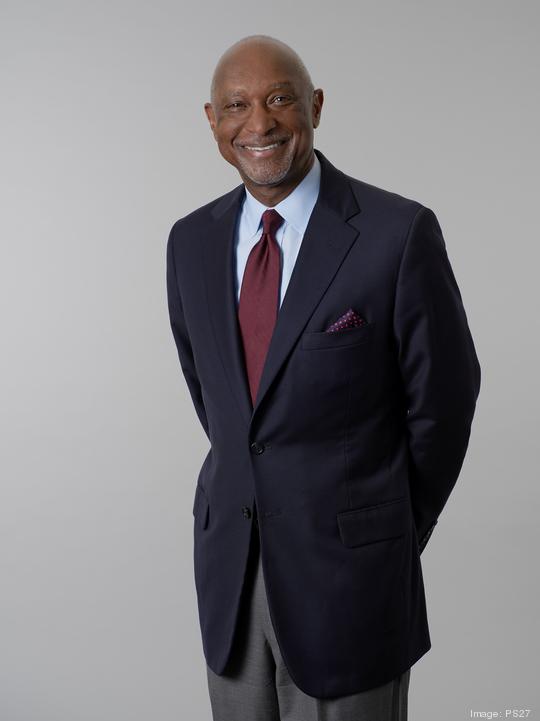

"We've been discovered; people know it's a great place to live and work," Jim Stallings, founder and CEO of PS27 Ventures, said. "We're putting our flag out there saying, 'We’re part of this too.'"

PS27 Ventures, a Jacksonville-based firm founded in 2013, has launched the early-stage focused fund called the "Rhea Fund." It will focus on early-stage companies, funding Series A rounds with a specific focus on the SaaS, HealthTech, FinTech, sustainability, and e-commerce industries. Check sizes will be in the $500,000 to $1 million range.

"One of the things we're seeing is a wave of new innovation — I think it's driven off the pandemic," Stallings said. "People were inventing things, and now they're coming to market. We're seeing it in our pipeline and said, 'We want to be part of that.'"

The "Rhea" name has multiple meanings — Rhea is a woman's name, which Stalling said references the fact he wants 50% of the fund's investments given to women and people of color. He has also always been fascinated by space, and Rhea is the second-largest moon to revolve around Saturn.

The fund is intended for a five-year duration, but Stallings said he expects it to get spent much quicker than that.

"I think we will look back 25 years from now and say, 'We're in the largest innovative boom in 100 years,'" he said. "And we said, what's the best way to participate in that? Let's invest. There's no scientific evidence to that; we're just overwhelmed with smart, talented people."

Rhea has been eight years in the making, after the organization spent time building the "PS27 Process" of vetting and helping companies.

"The other great thing we've been able to do over the last eight years is build relationships with companies, universities, incubators, and accelerators that have talent," Stallings said. "Talent won’t walk in the door. You have to build connections. We say to the entrepreneurs, 'We've got money, connections, and a whole community to help you.'"

While the fund is Jacksonville-based, it will focus on the Southeast region. However, the firm's first investment was with Chicago-based levAR, which offers an augmented reality e-commerce solution.

"That's the beauty of the last year; you can work from anywhere," Stallings said. "We talk to people all over the world. The question is, can you take it to market? And where is the money to help you? But you don't have to be in the same building anymore. You can be where the solution is."

The Rhea Fund follows on the heels of TampaBay.Ventures Fund, another $20 million fund, launched in May with a specific focus on the Tampa Bay region.

"There is always room for more," Stallings said. "We need 10 other firms like me. The market is growing, and the inventions are there."